Securing financial futures and the case for goal-based financial planning

7 Aug 2021 — D91 LABS — TALES OF BHARAT

The Ant and the Grasshopper is a beloved story from Aesop’s Fables.

The ants in the story diligently laboured every single day through the summer to save for the winter while the grasshopper sang and made merry all summer long. When the bitter winter came, the grasshopper, with nothing saved, found itself begging for sustenance at the doorstep of the hardworking ants.

Growing up, I heard the moral of this story recounted over and over, as I am sure did most children as their parents tried to drill into them the idea of saving for a rainy day.

The notion of protecting the future by setting aside a portion of what you have today has been the bedrock of financial decision-making for generations in the Indian household. The sagacious wisdom in this approach is obvious but is it sufficient to secure the financial futures of the present-day household, with all of the unpredictable complexities?

Let’s see what Suresh and Rekha’s financial journeys reveal to answer that.

Suresh works as a migrant construction worker in Pune and lives with his wife, Rekha, and their daughter, Kiran. Rekha works as domestic help with three families in their locality and Kiran goes to the nearby high school. Their family of three lives in a small rented flat in the city through the year and supports Suresh’s parents back in their native village. About six months ago, Suresh was injured in an accident and needed urgent surgery for which the family had to take a loan of Rs. 10,000 from a local moneylender, repayment of which is ongoing. During the month of June, Suresh travels back to his village where he tends to and sows crops on a small farm which he owns jointly with his brother.

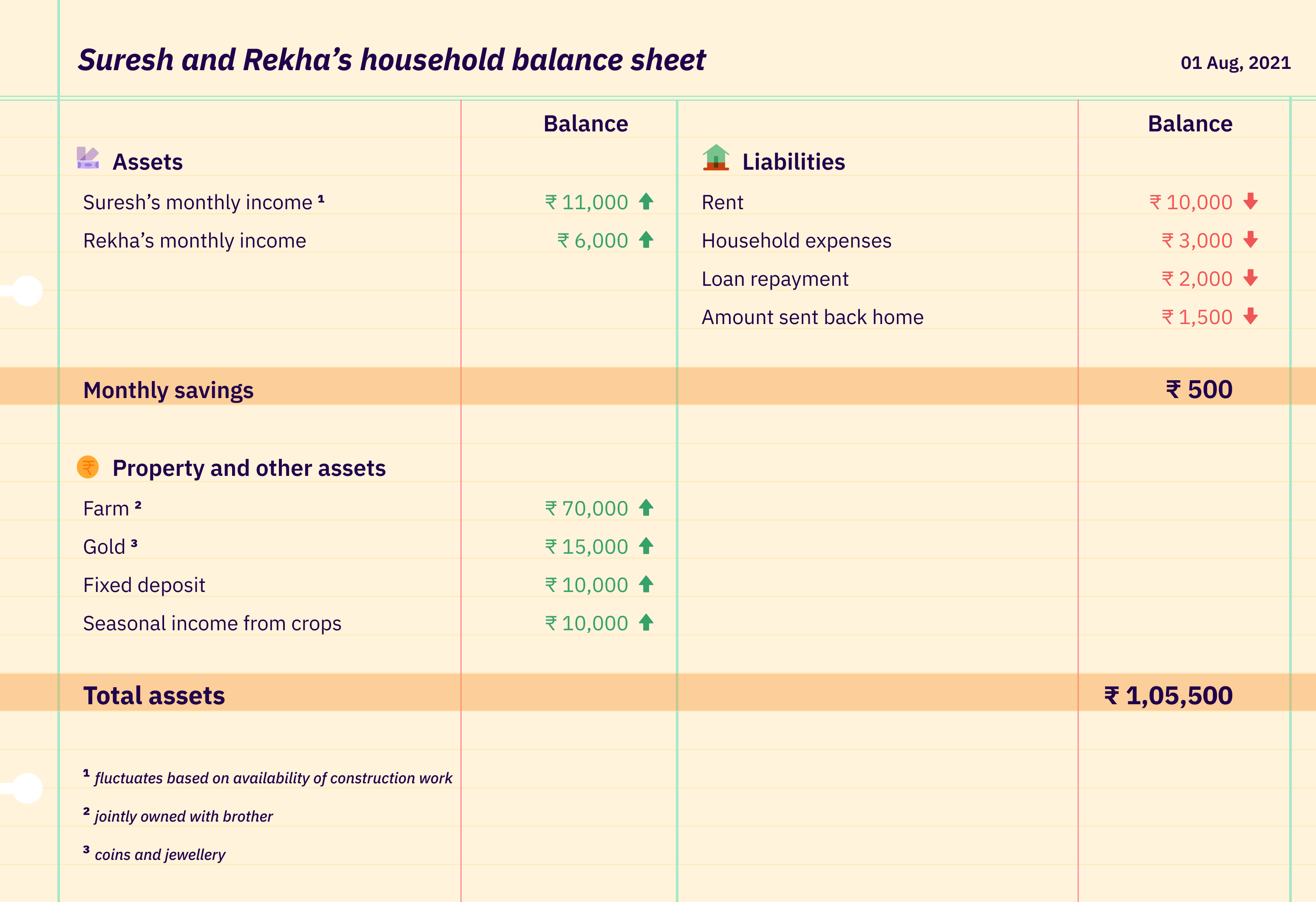

If Suresh and Rekha’s finances were an asset-liability ledger they would look something like this:

Suresh and Rekha’s monthly asset and liability tally show that their current monthly income allows them to meet their everyday expenses but their disposable income at the end of each month fluctuates and their savings, if any, are far from consistent.

Looking to the future, Suresh and Rekha aspire to own a small flat in Pune and would like to marry their only daughter with some pomp and circumstance. As for Kiran, she loves numbers and hopes to become a chartered accountant when she grows up. Suresh and Rekha’s aspirations for their family’s future look a lot like those of many households in India.

Armed with the mantra of saving for a rainy day, it is evident that Suresh and Rekha are thinking of their financial future.

As the ledger shows, Suresh and Rekha’s disposable income and their wealth at this stage in their life is mostly held in physical assets - real estate and gold reserves. This is not surprising since historically, wealth in Indian households has been held in the form of physical assets. When financial stress (due to cash flow shortages or an emergency) arises, these assets are often collateralized to obtain a loan. Their actual value and the value of loans from their collateralization make these assets a useful savings vehicle. Large parts of India still save the same way1.

Many attempts have been made to understand this decision-making process and this continued reliance on physical assets or cash as savings tools. We have come across the following broad reasons.

1. Financial assets v. physical assets

Physical assets such as gold or real estate are seen as reasonably stable in their returns. Also, gold has socio-cultural, economic, and religious significance in India. Finally, they are flexible in how much one can invest. For example, if Suresh and Rekha save Rs. 1,500 in a given month, they can theoretically purchase gold for that amount and in the months they get a share of the revenue from the sale of their crops, they could possibly save the Rs. 10,000 in gold as well. There is no minimum floor requirement in their investment. The value of gold or real estate appreciates slowly but visibly over time. It is a powerful appreciation that they have the knowledge and means to track.

In contrast, most accessible formal financial products (such as fixed deposits, chit funds, insurance schemes or loans) require consistent scheduled payments of a chosen floor amount. They are rigidly structured and do not offer the flexibility to cater to the seasonal or fluctuating nature of income of seasonal workers. This makes them somewhat inaccessible to those with differing disposable incomes at the end of each month. Any appreciation in the value of these assets may be significant but tracking it requires some level of financial awareness which makes it harder for many households.

2. The formal financial markets conundrum

2. The formal financial markets conundrum

Formal markets for financial assets such as stocks, mutual funds, insurance or pension schemes, or even institutional debt have a definite upside to their use. The nature of returns, their frequency, and their flexibility of disposal make these some of the most useful investment tools available today. However, their use is limited by access to the formal financial markets. In the case of low or medium-income households, there exists a trust deficit when it comes to the use of sophisticated and dynamic financial products. Therefore, these assets are seen as a prerogative of the elite and the technologically savvy.

On a related note, there are a number of bureaucratic hoops that one needs to jump to get access to these services. Complicated paperwork, administrative rigmarole, and the need to have the confidence to represent oneself make this an uphill battle for so many. This leaves them with little choice but to rely on their traditional knowledge of ownership over physical assets, to save in cash or use products from informal markets2.

3. You fear the unknown or well, less known

3. You fear the unknown or well, less known

Similar to the lack of access to financial markets is the related lack of access to information about financial products at the right time. This information is the baseline understanding of the ‘what and how’ of financial products and the risks associated with them. Being inextricably tied to the issue of trust deficit, the lack of information on financial products pervades even in those places where there is an availability of physical offices/ branches of financial institutions. Improving access to this knowledge requires a humane and targeted approach, both of which are not always forthcoming for all segments of the population3.

Access to the internet and smartphones has had a visible impact on improving financial knowledge. However, until such time that their penetration is more absolute, there will continue to exist a gap in information availability and therefore a need to bridge this gap manually through concerted effort on part of financial institutions. In stark contrast, gold and real estate are traditional asset pools that most people understand almost instinctively, and as such the bias towards their acceptance and hesitancy in approaching the great unknown of financial products is but natural.

4. Gifts and wills - intergenerational transfers in the Indian family

4. Gifts and wills - intergenerational transfers in the Indian family

India has a long history of familial ownership of assets and the hereditary transfer of such assets. Ownership of physical assets and their intergenerational transfer makes them coveted sources of wealth that families collect in the hope of passing them down generations. These have socio-economic and cultural significance in most societies across India4. Laws have acknowledged the importance of such transfers and their value to the fabric of familial relationships. Financial assets are a lot harder to weave into this fabric and are therefore often kept out of the pool altogether.

So can ‘savings’ really get you that secure future?#

The above reasons notwithstanding, the motivations of a household when choosing where to save are unique to them and these may not always be apparent. It has been observed time and again that most household needs (aside from everyday expenses) are geared towards life events - higher education, marriage, health-related set-back, accidents, etc. The reliance on loans from external sources or from social channels (like Suresh’s when he met with an accident) shows that savings in physical assets alone cannot efficiently safeguard their needs for the future.

Further, physical assets are not without their kinks. Their valuation invariably requires an external third-party valuation, ownership is often joint and reliance on family is an intervening factor in their disposal. In times of crisis or emergency where time is of the essence, these assets have proven to be much harder to offload, than their financial counterparts.

When fashioning a financial journey, the greatest faux pas that people make is using savings and investments interchangeably. How are they different you ask? Well! simply put, investments are a type of savings that generate future income but that is not always true for all types of savings. Cash in a safety deposit box is saving but it does not generate the same kind of returns as cash put in a fixed deposit or a mutual fund or even gold for that matter. Similarly, money invested in some kinds of assets yields more return than others. Each investment tool has its own pro/ con list and common sense dictates that the focus of financial decision-making should be on those kinds of savings that generate the highest returns in times of need.

The traditional modes of holding wealth and savings have come under pressure from shifting demographic patterns, social norms, and changing economic conditions, introducing risks to economic well-being especially as households age5. Fintech innovations in this space have made it more viable for classes of people that have traditionally been savers to become investors, through products targeted towards their financial journeys and fulfilment of their goals.

So, the only question that remains to be answered is well, what options do Suresh and Rekha have? Stay tuned for Part Two of this blog to find out!

All illustrations by Prajna Nayak.

Do you want to dabble in research and writing? We’ve started a new initiative at D91 Labs called The Inner Circle where we invite you all to come to collaborate with us! Curious? Read more about it here.

1 Report of the Household Finance Committee, ‘Indian Household Finance’, July 2017.

2 Ibid.

3 Madhurantika Moulick and al, ‘Understanding and Responding to the Savings Behaviour of the Low-Income People in the North East Region of India’ 2008, MicroSave, Pg. 11.

4 Rakshith S Ponnathpur and Monami Dasgupta, ‘Savings in Gold by Low-Income Households’, May 2020, Research Brief, Household Finance Research Initiative, Dvara Research.

5 Report of the Household Finance Committee, ‘Indian Household Finance’, July 2017.