UPI 103: The Settlement

8 Aug 2021 — PRODUCT — THE OTHER SIDE

In this article, we are learning about India's Unified Payments Interface. A four-year-old payment scheme that has been accounting for 40-45% of digital payments across India. In December 2019, Google recommended the Federal Reserve to follow the model of UPI for the design of FedNow.

It is going to be a 3 part series.

Part 1: We covered the background and basics. We learned about the different participants and their roles in the UPI ecosystem.

Part 2: We took a deep-dive into UPI by tracing a UPI transaction from the beginning through the end.

Part 3 (this article): We will look at settlements and understand how money exchanges hands.

In the last part, we debited Alice’s account and credited that money to Bob’s account. Alice banks with HDFC Banks and Bob banks with SBI.

Although, Bob received money in his account realtime, their banks didn’t really exchange money.

That’s where the settlement function of NPCI comes into the picture.

Every member bank of UPI needs to have an account with Reserve Bank of India. In short, RBI is the bank of all banks.

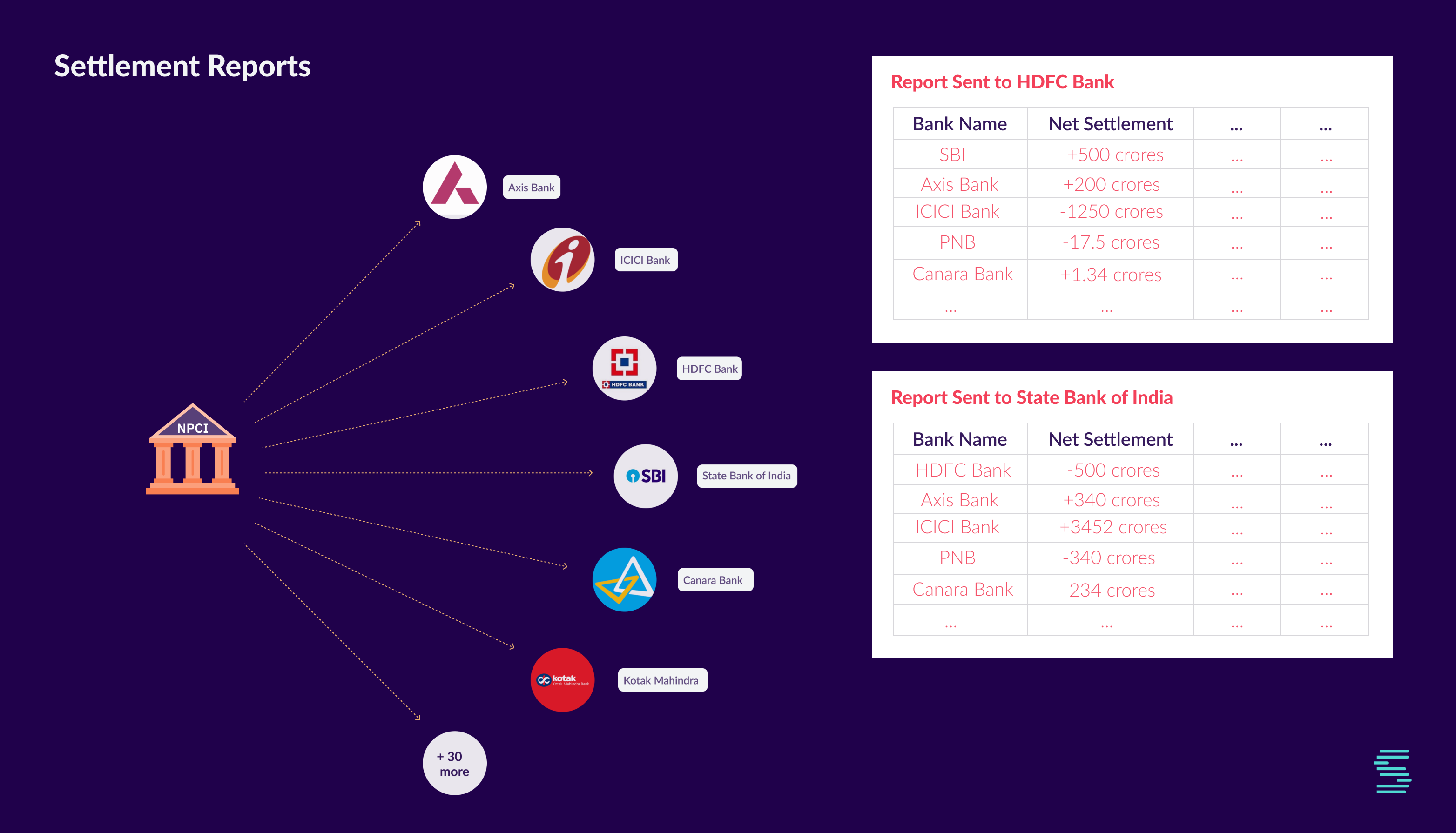

In the example we saw, Alice sent Rs. 1000 to Bob. Over time, many more transactions happen. Once in few hours, NPCI combines all the transactions that happened during the last period and creates a bulk settlement file. It creates settlement reports that are customized to every bank and sends it to every member bank involved. All banks do an internal computation to find how much do they owe someone or how much some other bank owes to them.

Let’s take a look at files sent to HDFC and SBI.

In the report sent to HDFC, the net settlement for SBI is at +500 crores. It means that HDFC has received 500 crores in excess of what it sent to SBI.

On the other hand, in the report sent to SBI the net settlement for HDFC stands at -500 crores. It means that SBI has sent 500 crores in excess of what it has received from HDFC.

The conclusion is that HDFC owes SBI 500 crores.

If we recall, both HDFC and SBI have accounts with the RBI (the bank of banks). Now, HDFC issues an authorization to RBI to transfer 500 crores from its account and credit it to SBI’s account. RBI checks the authorization and finally updates the ledger.

The transaction is now complete.

That’s a wrap of the series, now you know how the UPI Payment System works.

What can you do now?

-

Hop onto the UPI bandwagon. Build something cool using UPI. We make it really easy for developers to get started on financial services. Check out our website for more details and here’s a quick link to our docs.

-

If you have more questions, feel free to post them on our fintech forum.

-

And finally, share it with your friends who are curious about technology, payments, fintech or anything in general.