Are we breaking the barriers with fixed deposits?

9 Aug 2022 — PRODUCT

“There is no use in running behind these new modes of investments if you actually want to save money. Go park your funds in fixed deposits.”

—Every Indian father.

It’s a long known tale — Indians and their love for fixed deposits.

Fixed Deposits are the much needed assurance in the troublesome financial environment we live in. Not everyone has the risk appetite for stock market investments. For the majority of Indians, it is customary to invest their money in FDs.

According to a survey by SEBI, 95 percent of Indian households prefer to invest in bank fixed deposits (FDs) because they are not market-linked products, while less than 10 percent are interested in investing in mutual funds or equities.

In that case, fixed deposits emerge to be a messiah, and secure hard-earned savings with RBI-regulated banks.

In 2020, 46.2 trillion rupees were held in FDs as a separate asset class by Indians. So it is safe to say that —Fixed Deposits are India's preferred savings vehicle.

In these trying and turbulent times, having a 3-6 month emergency fund is always a good idea - and FDs make their case for why they should be in your investment portfolio. In addition, when banks provide them, you have the choice to receive interest either monthly or at maturity. Therefore, an FD is an excellent tool to mobilise your savings. This category of saving is also a viable alternative for investors who seek just assured profits and have a very limited awareness of risk.

However, not much innovation has happened in this space. While buying gold is easier than ever, fixed deposits have lacked the lustre to move forward with time. It should be as straightforward to reserve a fixed deposit as it is to make a UPI transaction. However, most banks ask users to open a savings account before reserving a fixed deposit.

Why aren't fintechs flocking to fixed deposits?#

If fixed deposits are so important, why haven't India's fintechs seized this market opportunity yet?

Integration with banks is generally painful for distributor apps (payment apps or investment apps). This is due to challenges with access to the right people at banks, parsing API docs, error messages and long-drawn InfoSec audits.

Distributors have also been unable to negotiate favourable commercial terms for themselves because banks do not see the effort as worthwhile. This discourages distributors from going through the tedious process of integration because the cost or the benefit analysis simply does not make sense.

However, this segment possesses an untapped potential thanks to the robust investments being made by Indians. As digital banking continues to expand at a rapid pace, businesses are feeling the need to do everything they can to stay ahead of the curve, and also to swifty respond to the industry's continual changes. Fixed deposits are compelled to change and must continue to do so. They must be able to favourably respond to the vast diversity of changes that the digital world dictates.

Companies that treat innovation as an art, on the other hand, believe that creativity should not be limited in any way. That is where Setu’s FD innovation comes into play.

What is Setu's fixed deposit product?#

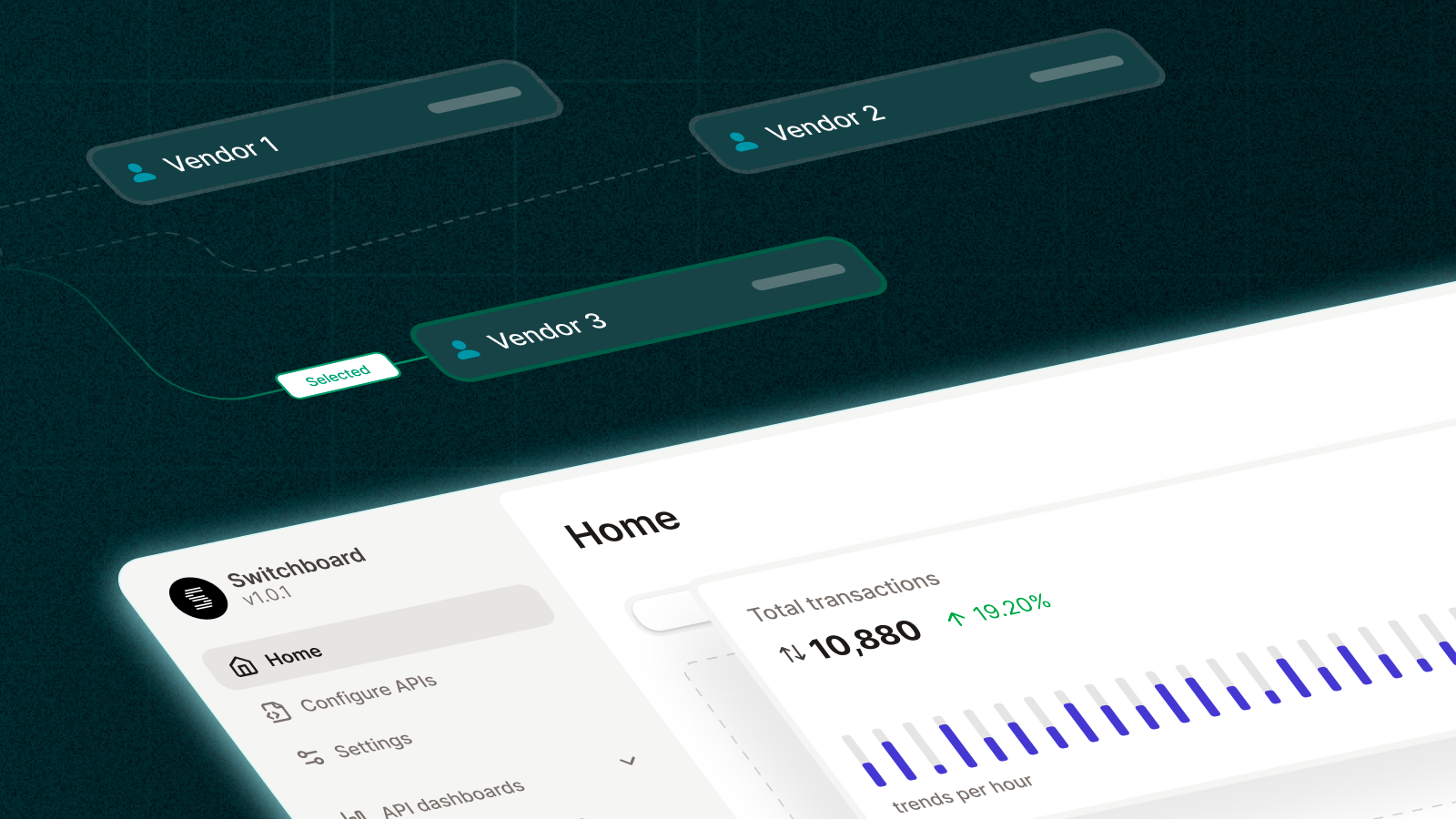

At Setu, our offering to the market is simply a standardised set of plug-and-play APIs that allow developers to access fixed deposit products from various banks. The FD APIs at Setu, in a nutshell, assist supply partners —financial institutions such as banks and non-banking financial companies in integrating with distributor partners like PhonePe, Google Pay.

Setu's banking and NBFC partners will benefit from an increased flow of funds and customers without having to spend a significant amount of money on customer acquisition cost and individual APIs.

Setu can assist a distributor to significantly expand their coverage of investment instruments and offer proprietary ones without having to integrate with each bank or NBFC individually. This also opens up a new revenue and data channel while reducing developer workload, testing, and downtime, allowing faster go-to-market (GTM).

To dive deep into Setu’s fixed deposit product,click here.