"SMBs are the backbone of our economy, contributing significantly to growth, employment, and innovation in India." - Narendra Modi, Prime Minister of India

Vishal Chaudhari is a senior Product Manager at Flexiloans— a digital lending platform that provides collateral-free credit to Small and Medium Businesses or SMBs. As a senior member of the product team, Vishal tries to identify and understand high-friction steps in Flexiloans’ lending journey. Vishal collaborates with his engineering team to refine and enhance these critical friction points, ensuring a smoother, more efficient lending process.

An end-to-end lending process can be broadly broken down into 4 key stages—Originating a lead, onboarding or conducting KYB, underwriting based on the data received, and payments—which include NACH setup, loan disbursement, and EMI collections.

A step that Vishal—and several other fintech PMs—find tough to optimise is the step right before underwriting— bank statement collection, a critical step in the KYB process.

Bank statements give a deep view of an SMB’s or individual’s financial health—it helps a lender understand inward cash flows, recurring expenses, borrowing history, current loans/EMIs, cheque bounces, and other such indicators. In the context of creditworthiness, these factors assess whether the MSME and its proprietor are willing to repay and able to repay. Hence, it’s imperative to collect bank statements to underwrite effectively. However, collecting bank statements has been an inherent pain for lending institutions in the country. The most common method is asking borrowers to share a PDF copy of their bank statement.

It is an operation-heavy process that involves a robust CRM, a PDF parser, and manual efforts by operation executives. Moreover, statements from banks are not standardised, hence, verifying them is complex. Also, bank statement PDF uploads have high fraud risks. The turnaround time (TAT) for Flexiloans to disburse a loan was around 3-5 days. This is still a pretty impressive TAT for a lending institution with 1000 cr AUM (Asset-Under-Management).

But Vishal and the Flexiloans team knew this could get better.

They had been following the developments of the Account Aggregator ecosystem and were pleasantly surprised to see it in action during a few product demos. It seemed to be the best solution for them to optimise this clunky step of bank statement collection.

Vishal and the Flexiloans team had came across Setu’s simple documentation on the Account Aggregator APIs. It seemed very easy to integrate too. Setu’s AA APIs could be broadly broken down into 3 simple flows—consent, data, and notifications. Seemed simple enough to try it out.

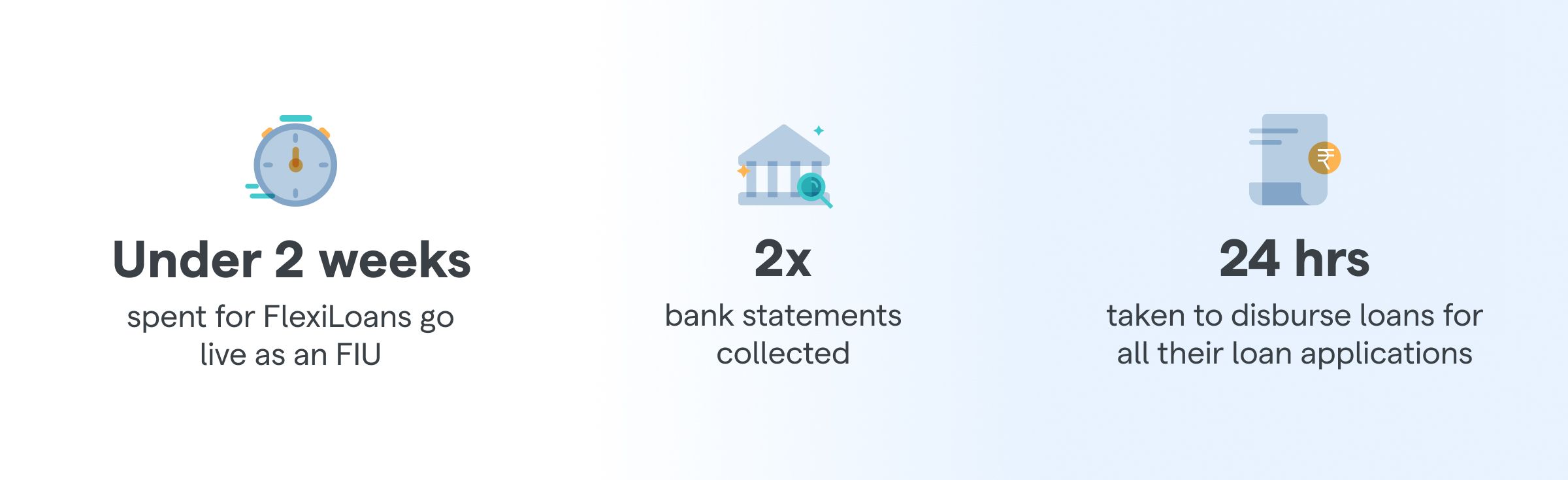

Flexiloans integrated Setu’s Account Aggregator APIs and went live as an FIU in just under two weeks. With Account Aggregator, Flexiloans was able to collect double the bank statements than before. An immediate 2X jump! That too, in just a few minutes.

The success of the Account Aggregator implementation enabled Flexiloans to disburse loans in under 24 hours for all their loan applications. Promising indeed.

Vishal and Flexiloans are also excited about the advent of the GST data on the Account Aggregator framework. With GST, they can get invoice-level data so an SMB’s financial health will be as realistic as it can get.

Exciting times ahead.