Quite a few times, over the past couple of weeks, every time someone asked me where I worked, and what my company did, I found myself pausing for a couple of moments while I furiously try and concoct a comprehensible, yet sufficiently succinct reply.

“Do you want the short version, or the long version?” I ask back, stalling for more time. If they pick the latter, I breathe a sigh of relief, and launch into a ten-minute spiel on how we would make poverty history and cure world hunger. If they pick the former, I panic. It is far more treacherous to sum up Setu in a few words than to talk about it for a prolonged time. So much so, that I told a clueless uncle that we make bank software. He nodded, and thankfully, that was the end of that.

But, anyway let me try, with one of the many phrases I use—

Setu creates software infrastructure for companies that help make financial inclusion possible.

Did you get that? Well, there’s a bit of jargon, I know. Let me do the long version, that should clear things up quite a bit.

So, let’s start at the beginning—we can all agree that India is still a poor country. Our economy is still growing, and growing well, but there’s still a lot of ground to cover before we catch up with the other front-runners. How can we close this gap? How can we hasten the process of economic growth?

This is where the middle-class comes in. And when I say middle-class, I don’t mean you or me. We delude ourselves into thinking we are, but are we really? We commute in air-conditioned cars, we buy groceries online to be delivered in an hour, we get salaries into our bank accounts, we celebrate at pubs drinking imported beer, we invest our money by just tapping buttons on our fancy smartphones. No sir, we are not middle-class—we are the top 5%. India’s true middle class are the half a billion people who lurk outside the financial walled garden. Some have bank accounts, but nearly all wouldn’t qualify for a loan. They are clueless about the stock market. The are unaware of mutual funds and how they work. These are people we see everyday—your portly apartment security guard, the old woman you buy your vegetables from, the frail boy trying to pay for college by delivering food to your doorstep. They are visible to us, but not to the institutions that have the power to change their lives.

These people are unable to gain financial independence simply because no financial product, such as a loan or a mutual fund is tailored for them. The aforementioned vegetable seller doesn’t need a 75-lakh-home-loan-at-floating-point-interest. She needs a 1500-rupee daily line of credit with low-interest and short tenure to make her purchases and not be dependent on daily sales. The security guard, likewise, wants to invest Rs.100-a-day in a highly liquid instrument, instead of locking it away in a fixed deposit for three years. The delivery boy doesn’t have insurance, because he can’t afford a Rs.30k premium every six months for the next decade.

See the general trend here? India’s middle-class—let’s call them ‘Bharat’, shall we? — needs a small ticket-size variant of the financial products the rest of us take for granted. They are not interested in the 750ml L’Oréal bottle with the easy-squeeze actuator, they go for the 3-rupee tear and toss packet instead. This ‘sachetisation’ is what Bharat needs to be financially independent like the rest of us. This is what will give them financial inclusion, and in turn, the big-picture, pave the way for India’s economic growth. Imagine a fifty million more of the population, each of them running their own small business, and contributing to the tax base. Now imagine 10x that. Crazy, huh?

Now, how would this be possible? No way these banks and insurance companies and mutual funds have that kind of setup to offer Bharat what it needs, right? The average processing fee for any kind of loan runs into the thousands, so it doesn’t make sense to offer a 25,000-rupee loan to a farmer who just walked into a branch with high-hopes of expanding his fields.

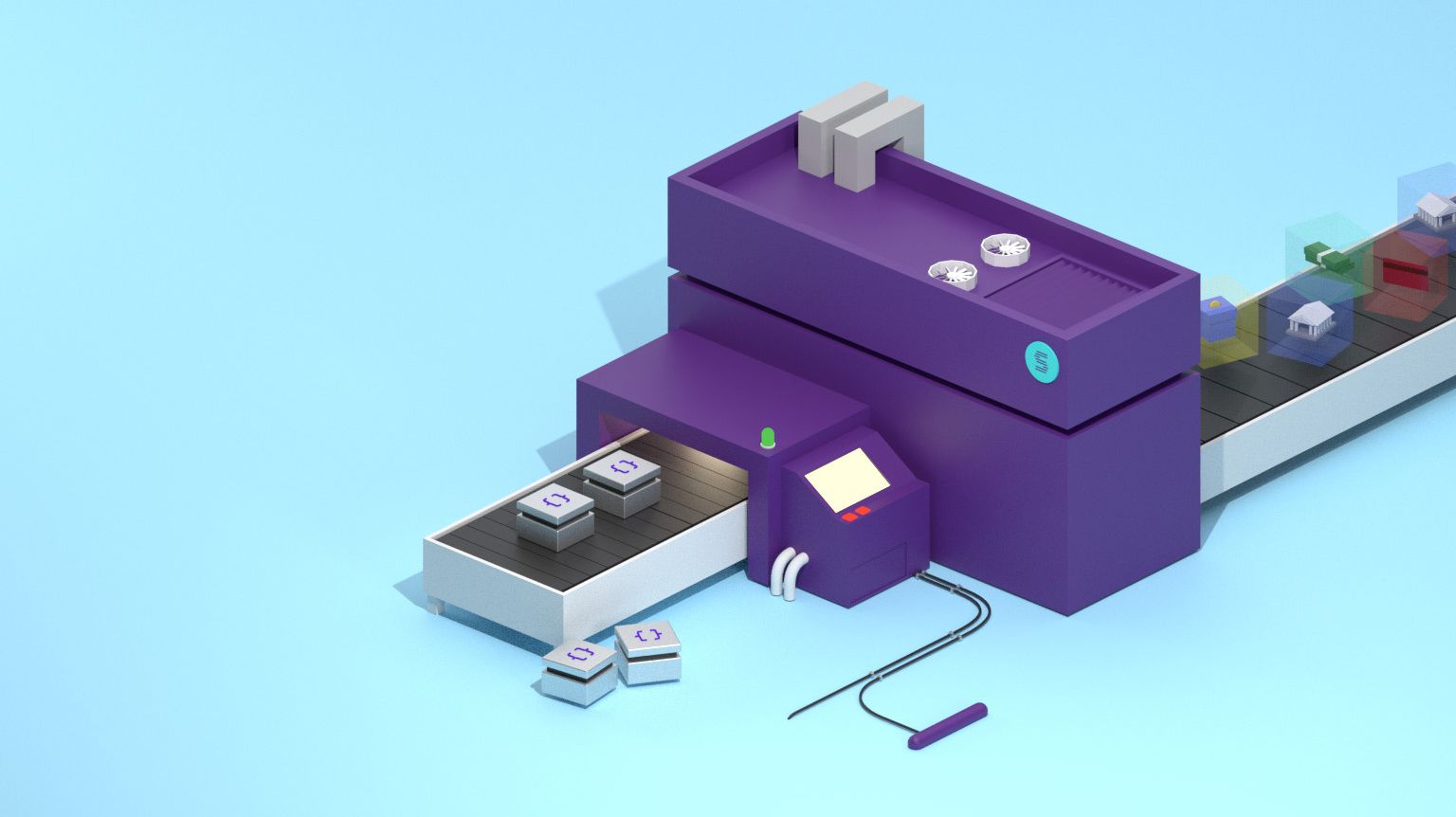

This is where Setu comes into the picture. We firmly believe that the only way to make these products accessible to millions more is to remove the red tape involved, and instead switch to a completely digital infrastructure that can handle these small-ticket, high-volume transactions. We aim to break these financial products into their fundamental building blocks, and offer them as APIs to developers and companies. They can then package these APIs into highly custom apps, tailor-made for their customers.

Some of you developers reading this just sat up in your chairs, didn’t you? It makes a lot of sense, doesn’t it? Think of a marketplace for fintech APIs, that developers can cherry-pick to cater to the specific needs of their niche customers. Looking for a bill-payment app just for your gated community? Or a micro-insurance portal for your employees? How about a loan that is automatically disbursed based on your current GST bill? Distinct use-cases with spectacular solutions, all available at your fingertips.

We are in the process of building a rock-solid API platform, open to any developer looking to build fintech applications. This platform will power India’s financial infrastructure needs tomorrow—we are getting ready today.

There, that was the long version. That cleared things up a bit, I hope? Good. This seems to work on most people I have spoken to, too. A few raised eyebrows here, a couple downturned lips there, but seems to work for the most part. I will refine this a bit more, soon.

Now, on a side note—were you one of the developers whose eyes lit up at the idea of this stupidly-awesome nation-scale platform? If yes, we want to talk to you. We need your help making this a reality, we need your help to make financial inclusion possible for half a billion people. We need your help to drive India’s economic growth.

Write to us at careers@setu.co—we’d love to hear from you.