The Account Aggregator Consent Conversion Crisis

19 Mar 2025 — ACCOUNT AGGREGATOR — FREE YOUR DATA

ACCOUNT AGGREGATOR

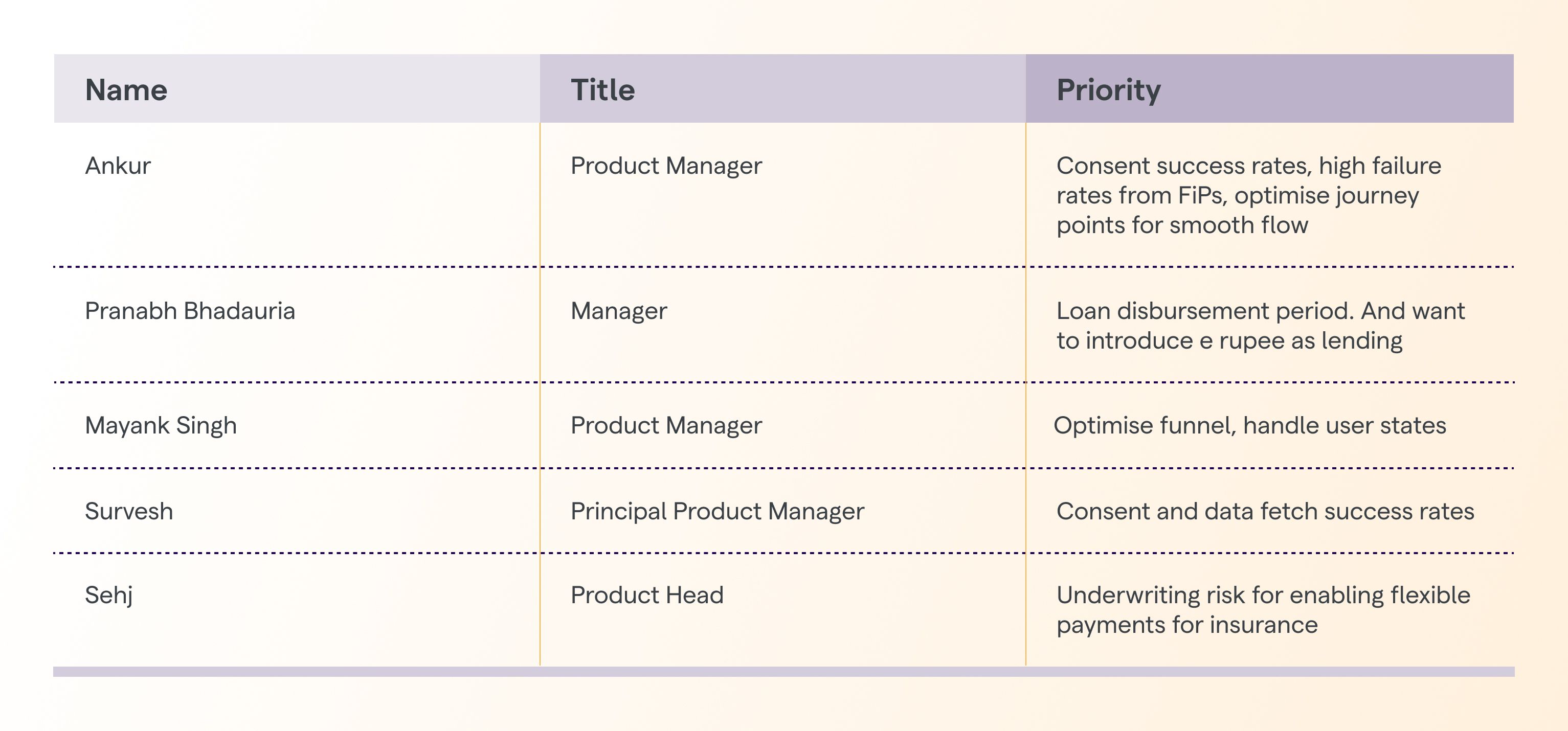

While industry reports celebrate Account Aggregator's impressive growth in data access, our webinar participants revealed they're tackling a crucial reality: low AA consent conversion directly impacting bottom line, customer experience, and ability to address India's ₹25.8T credit opportunity.

Uncovering the Real AA Implementation Challenges#

"I wasn't expecting this," I said to Atreya and Sivagar, staring at the spreadsheet of registrations for our upcoming Account Aggregator webinar. When we created the signup form, I added an optional field: "What is your biggest AA implementation challenge?"

I expected technical questions about API integration or data standardisation. The responses however surfaced urgent business problems:

-

Customer drop-offs during AA consent process

-

Incomplete data from multiple FIPs—Financial Information Providers

-

Unable to observe patterns and generate actionable insights

With just a few days until the webinar, we realised our presentation needed adjustments to address the real challenges FIUs (Financial Information Users) are facing.

AA implementation for different types of lenders#

Our initial focus for the webinar was to highlight the market opportunity of Account Aggregator: a 1,000% increase in data access, a 47% surge in small-ticket loans, and a ₹25.8T credit gap that effective AA implementation could address.

As the number of responses from the signup forms increased, a clear pattern emerged: lenders face unique AA challenges based on their business models and tech capabilities. Traditional banks, digital-native fintechs, and embedded lenders each experience the AA journey differently.

One bank's digital head shared their AA implementation experience, noting the difficulty of maintaining consistent AA data fetch success rates despite significant investment.

This contrast between market potential and implementation reality formed the central theme of our discussion. Our observations reveal distinct differences in how various financial institutions navigate the AA journey:

-

Traditional banks with robust tech teams integrate AA more smoothly.

-

Digital-native fintechs typically report higher AA consent rates.

-

Embedded lenders refine the consent flow to optimise point-of-need financing.

As with early UPI adoption—which initially suffered high transaction failure rates before achieving seamless performance—AA implementation requires time and refinement.

Key AA Challenges by Lender Segment#

The webinar discussion highlighted specific implementation challenges across different lender types:

-

Traditional banks and NBFCs struggle to integrate AA capabilities with legacy systems. This often results in extended development timelines and lower-than-expected data fetch success rates.

-

Digital-first lenders, despite having streamlined onboarding, experience high borrower drop-off rates during the bank verification step—directly impacting AA consent conversion and customer acquisition costs.

-

Embedded lenders offering point-of-sale financing face a time-sensitive challenge: delays in processing bank statements lead to abandoned purchases.

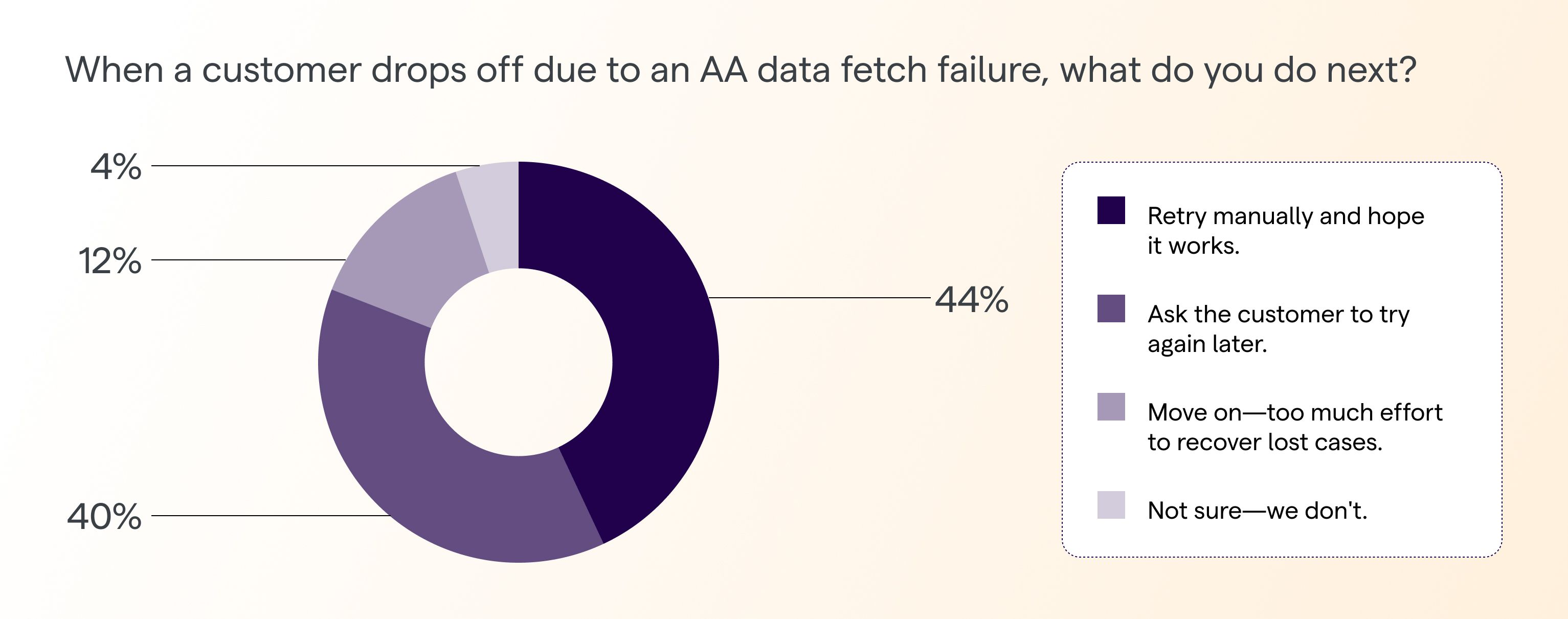

These responses suggest a predominantly reactive approach to what is fundamentally a systematic challenge within the Account Aggregator ecosystem.

The discussions turned solution-focused when we shared how Fibe increased AA consent conversion by 28% using a Multi-AA Gateway approach with intelligent routing. This case study demonstrated that system design improvements—not manual interventions—are the key to overcoming implementation challenges.

Business Impact of AA Implementation Challenges#

Technical challenges must be framed in business terms. Every failed AA consent flow represents:

-

Marketing spend that does not convert into revenue.

-

Digital-first lenders face high customer acquisition costs, but poor AA consent conversion means many prospects never complete onboarding.

-

Embedded lenders risk losing customers at checkout when AA data fetch delays disrupt point-of-sale financing.

-

A diminished customer experience that weakens brand perception.

For FIUs focused on growth and market expansion, improving Account Aggregator implementation is more of a business necessaity than just a technical upgrade.

For FIUs early in their AA journey:

-

Build for reliability from the start using Multi-AA Gateway approaches.

-

Design processes that mitigate common failure points.

-

Focus on extracting actionable insights, not just data collection.

For FIUs with established AA implementations struggling with reliability:

-

Use intelligent routing across multiple AA providers with real-time performance monitoring.

-

Automate handling of FIP-specific limitations using features like auto-chunking.

-

Develop segment-specific scorecards that account for different borrower profiles.

For FIUs focused on portfolio management:

-

Develop early warning systems tailored to specific customer segments.

-

Adopt proactive monitoring instead of reactive collections.

-

Design segment-specific risk indicators that align with borrower financial patterns.

The Path Forward for the Account Aggregator Ecosystem#

The Account Aggregator ecosystem is maturing, with the gap between potential and reality narrowing—though not as quickly as many had hoped.

Today’s challenges do not require discarding existing investments. Instead, financial institutions can enhance them through smarter routing, data handling, and analysis.

At Setu, we address these implementation challenges through our Multi-AA Gateway, data standardisation capabilities, and segment-specific insights, improving AA data fetch success.

Visit setu.co/aa to learn more about our approach. Or reach out to me at gunjan@setu.co if you would like a copy of the session recording.

The promise of Account Aggregator—expanding financial access while managing risk more effectively—still remains as compelling as ever.

L-R: Atreya, Gunjan, Sivagar

L-R: Atreya, Gunjan, Sivagar