What on earth is the UPI switch?

30 Mar 2023 — PRODUCT

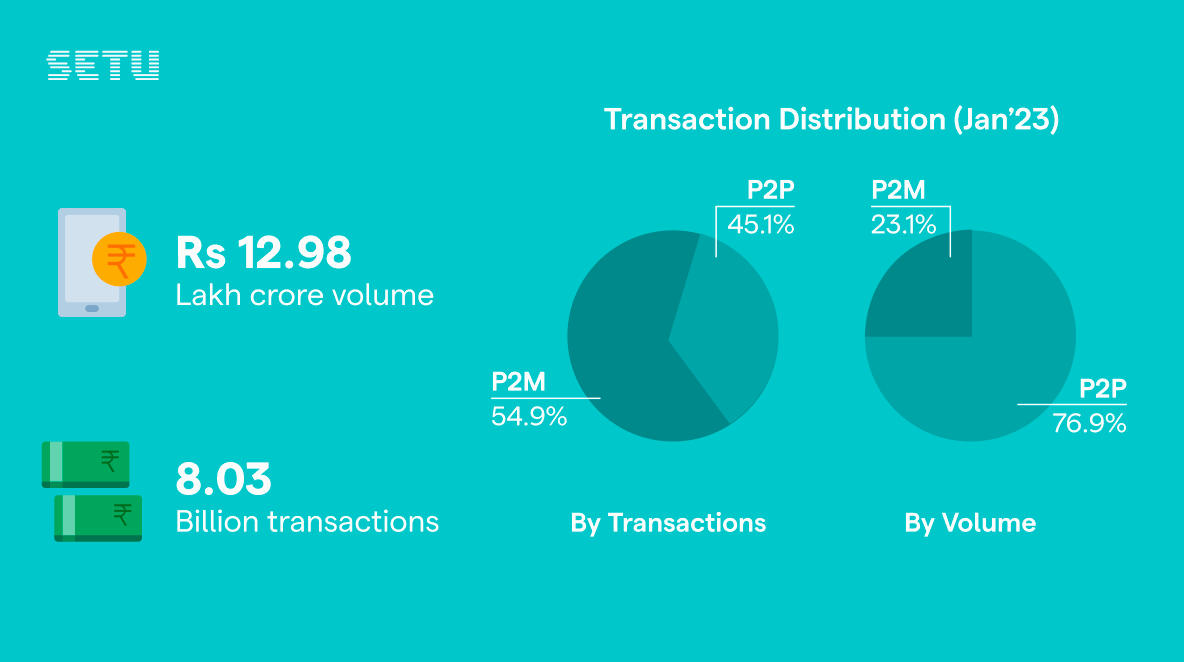

UPI is the most popular payment method, widely used by consumers and businesses across India. Since its launch in 2016, UPI has become synonymous with digital payments. Fast forward 6 years, 358 banks are live on UPI, processing just under 8 billion transactions a month. Of these 8 billion transactions, there is a 45-55 split when it comes to P2P (peer-to-peer) and P2M (peer-to-merchant) transactions.

The primary objective of UPI was to build an open payment system that is mobile-first, fast, and interoperable across different banks.

History 101 on UPI

For a developing country like India, going mobile-first was almost a no brainer. Mobile phones and data were getting cheaper and the trend was clear. Interoperability simply puts the user’s needs at the centre. The users can opt for any payment app, link it with their bank account to engage in commerce with anyone across India. Think about it, all of us want to use payment apps that we like, instead of being limited to a poorly designed app that’s provided by the bank where we keep our money. We should let banks do what they do best (which is managing money) and let tech companies handle building intuitive user interfaces for transacting money. UPI was built on this principle—let private companies innovate and build on top of public digital infrastructure. This scale is largely handled by NPCI or the National Payments Corporation of India.

National Payments Corporation of India (NPCI) is a non-profit set up by the Government of India to facilitate digital payments. They facilitate many payment schemes (like IMPS, BBPS, FASTag, etc.)

If we reflect back on the original objective of UPI, it was to build an interoperable system. Interoperable means that anyone could download a payment app, link any bank (that they use), and transact with anyone else from any other bank.

One primitive way of building such an interoperable network would be to connect every payment app with every bank. As you’re probably guessing, that’s a very inefficient way of doing it, even if we assume something like that is possible. But it is practically not possible. And, the only thing that’s constant in the software realm, is the fact that systems keep changing and breaking. Imagine the pain that everyone has to go through in reaching a consensus when configurations or infrastructures change. It would be chaos. This approach is the same as building an Internet where your browser has to remember the IP address of every possible website on the planet, otherwise, you wouldn’t be able to access it. Of course, the Internet is not built in this fashion. The job of resolving every web address into an IP address is taken out as a separate protocol called DNS. Our browsers trust the IP address resolved by the DNS servers used by our Internet Service Providers.

Introducing standardisation and a trusted third party will result in a completely different architecture.

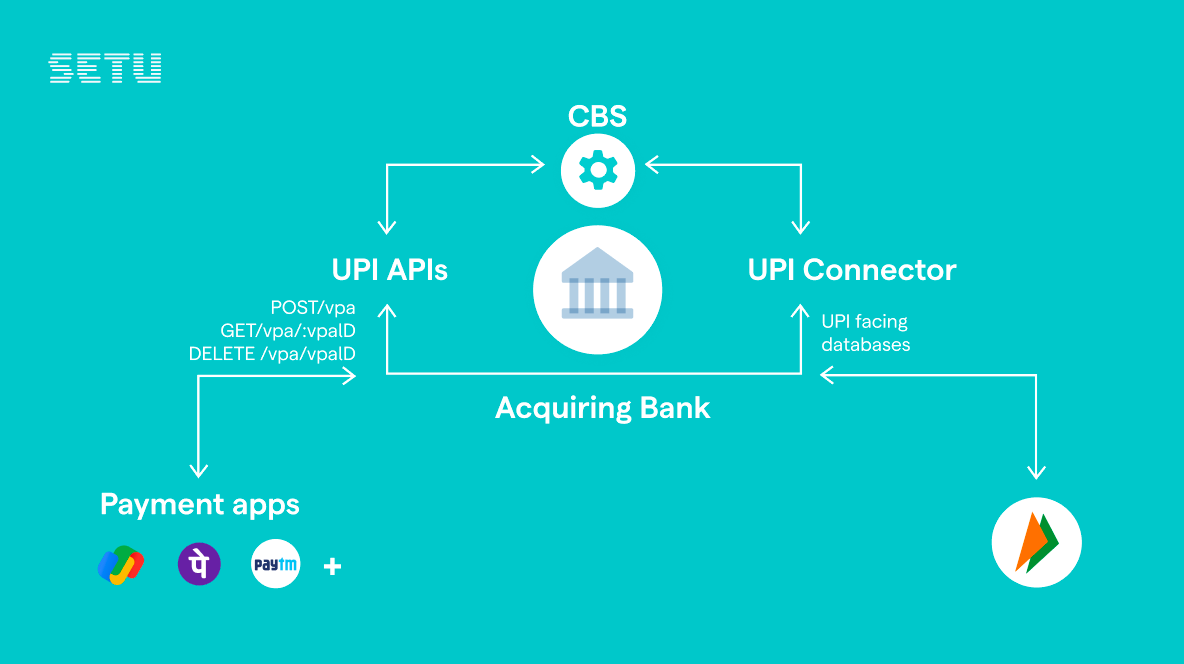

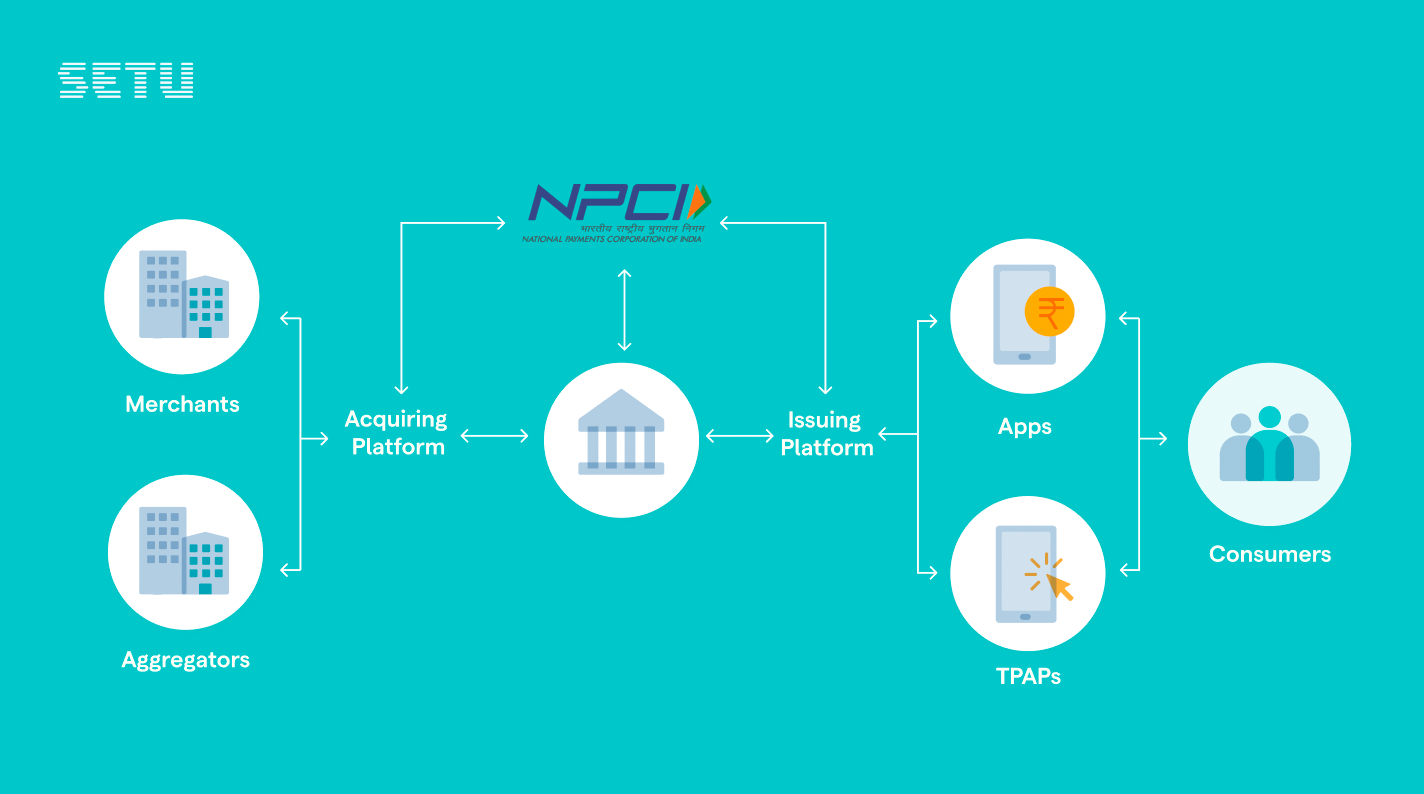

That’s the route UPI creators took, they made NPCI as the trusted central unit and they standardised the protocol. NPCI makes sure that data flow between banks and payment apps are routed to the correct and verified destinations. The end result, the payment apps, and banks talk just to NPCI and can be assured by NPCI that they are really interacting with who they intend to. All payment companies offering UPI APIs offer it through one or more of the registered banks on NPCI.

Okay, now let’s talk about UPI Switch.

Dilip Asbe, MD & CEO of NPCI announced digital India’s audacious mission— to enable 1 billion transactions a day on UPI in the next 3-5 years. Now, this is hard to achieve.

In order to reach this mammoth scale, robust payment infrastructures are needed to handle transactions at a huge scale and also to enable merchants to launch all the latest features on UPI like recurring payments, mandates, credit card linkage, and several others. However, to adopt any new feature on UPI, banks registered on UPI are required to build these features and offer them to merchants to bake into their products who then offer convenient payment mechanisms to their customers. Since the involvement of banks is high here, the speed of innovation has to slow down. Banks have a million other things to tend to and improving a tech infrastructure will never be their first priority. UPI Autopay has been live for a few years now, but the adoption and scale remain nascent.

This is where the UPI switch comes in.

UPI Switch allows payment infrastructure companies like Setu to directly connect with NPCI and enable fast GTM for any new UPI feature.

This will open up multiple new use cases on UPI and enable multiple cohorts of merchants to use UPI features and build better experiences for their customers.

Netflix and Spotify can offer subscriptions via UPI Autopay. Ride-booking platforms like Uber and Ola can offer UPI Lite for small-ticket transactions while commuting. Companies building for feature phone users can offer UPI123. Lending fintechs can offer UPI mandates and InvestmentTech fintechs can offer UPI SIPs. The use cases become endless. And the path to process 1 billion UPI transactions per day looks easier.

Setu is building a UPI switch to enable multiple use cases for our cohort of merchants.