Chit funds 101

6 Aug 2021 — D91 LABS — TALES OF BHARAT

Chit fund a.k.a chitty, bishi, or kuree is a popular financial instrument in India and one of the few instruments that combine the features of savings and credit. It serves as a financial tool that turns flows into a lump sum within a short period of time, with the option of withdrawing a portion of the money anytime during the tenure of the investment. Chit funds have a good mix of structure and flexibility with an inbuilt reward system to resist the temptation to liquidate the investment. In other emerging economies, it is also known as Rotating Savings and Credit Association (ROSCA).

So how does a chit fund work?#

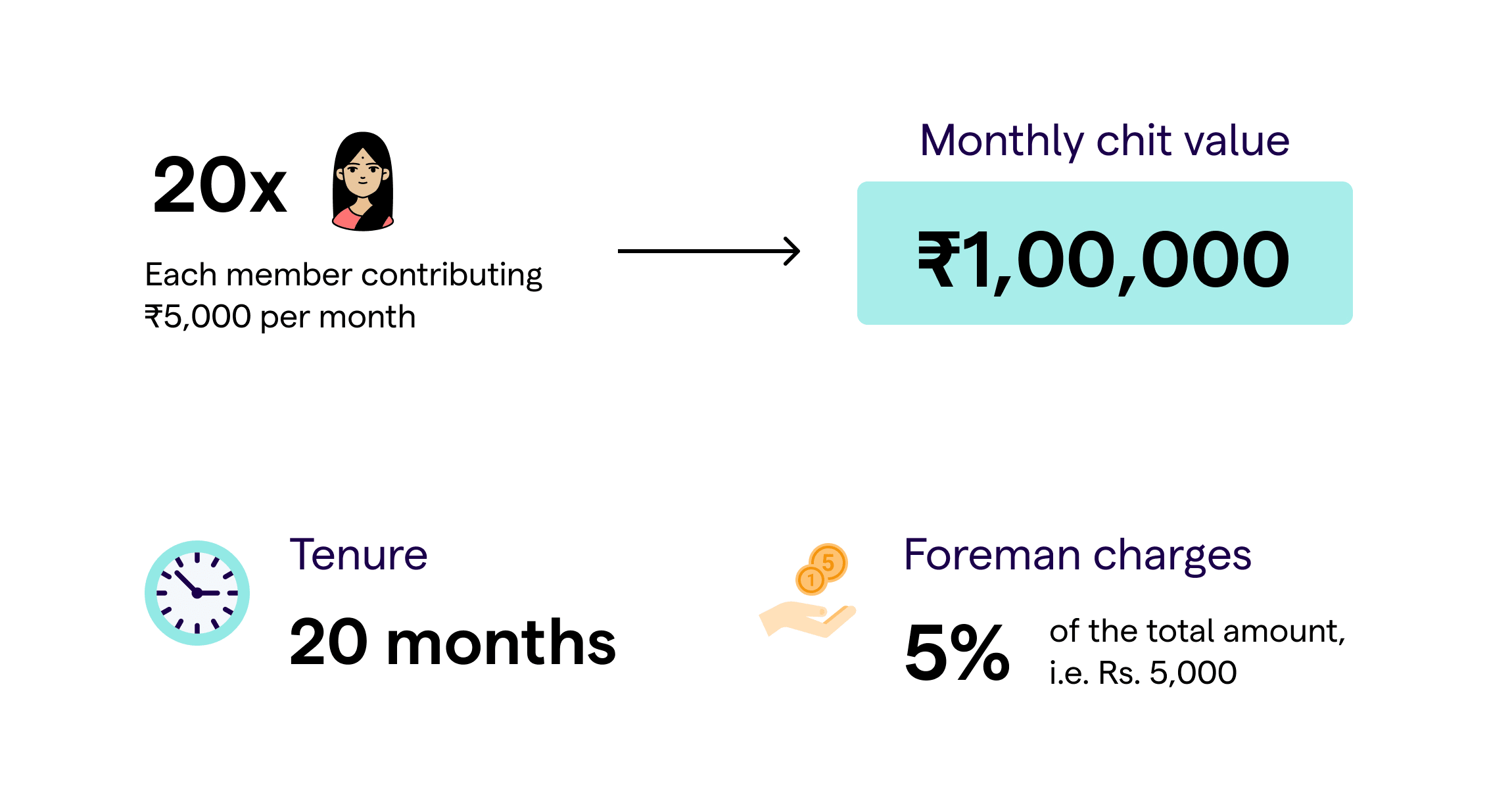

Let’s say there are 20 people in your society who want to come together and form a chit-fund group. Let’s name this group “Chitters”. Each member of chitters wants to save ₹ 5,000 in cash and preferably every month. They wish to invest for around two years but would also like the flexibility of withdrawing a lump sum in case they need the money for any reason. A rule of thumb for chit funds is that the number of group members is equal to the tenure of that chit fund. This ensures that every month one person can bid for the lump sum amount.

How is the Chit Fund group created?#

Every chit fund group requires a Foreman. In a registered chit fund regulated by the Registrar of Chits, a foreman needs to apply and be accepted by the Registrar. Upon receiving sanctioning rights, the foreman conducts, manages, and supervises the functions of this chit fund. However, in India, there is a huge market of informal chit fund groups and they are typically managed by either a trusted member of the community or by a moneylender. The fundamental rules of institutional and non-institutional chit funds are the same.

The Chit Fund Design#

Let’s say we start a chit fund group from January 2021 for 20 months. Each month the members of “Chitters” will meet on a specific day and deposit ₹ 5,000, making a total deposit amount of ₹ 1 Lakh together. Each month, the foreman will conduct a bid from people who wish to request the lump sum amount. This runs on the principle that people regularly face planned and unplanned events, for which they need a lump sum amount within a window of a few days. Of all the people who bid in a single round, the lowest bidder will get the lump sum amount. In case of no bidders, the foreman will randomly choose (or pick a chit with the name of a member - this practice gives chit funds their name) and give her the entire amount after deducting for foreman charges.

For instance, if there are 3 bidders Akshay, Simran, and Kuljit and they bid for ₹ 95,000, ₹ 90,000, and ₹ 85,000, then the lowest bidder will get the amount after adjusting for foreman charges/ organizer charges. Foreman charges are fixed at 5% of the total amount, i.e 5% of ₹ 1 Lakh which is ₹ 5,000 in this example. So, the lowest bidder, Kuljit, will now get a corpus of ₹ 80,000. To recap, out of the corpus of ₹ 1 Lakh, Kuljit gets ₹ 80,000, Foreman charges are ₹ 5,000 and the remaining ₹ 15,000 is the profit. This profit is shared equally among all the other 19 group members of chitters which sums up to ₹ 750 per person. This is considered as the reward for not withdrawing money in this round, and functions as a proxy for interest.

So, I am guessing you have figured by now that the lowest bidder, Kuljit, has got the money but has incurred a loss because he was ready to take home a lower amount as he urgently needed the money. And others benefited from his situation (this sounds mean but it’s true!). In this round, technically each person contributed ₹ 5,000 minus ₹ 750 i.e. ₹ 4,250. Also, Kuljit cannot bid from the next round but has to keep depositing ₹ 5,000 till the end of the tenure of this chit fund.

Next month, the same cycle continues and each member who’s not withdrawing is actually contributing less as the profit is shared among the members! This way each month all the people equally contribute to the corpus, someone takes the money by bidding the lowest, a foreman gets his charges and the rest money is divided back to members. The person who takes the money at the end will get all the money except the foreman’s fee, as there is no one else to bid now. So the last person will get ₹ 95,000 plus all the money she made through profits. There are multiple versions of chit funds but the core design of the instrument remains the same.

There are multiple reasons why someone would choose to invest in a complicated product like chit funds. Two main reasons are familiarity with chit fund- group members and access to liquidity within a few days. There is a lot of versatility in the usage of Chit funds. They are used for short-term and long-term goals life goals such as children’s education and marriage. They are also used for social obligations and festivals. In fact, some chit fund group members also use the lump sum amount to on-lend and become informal financiers.

These insights highlight the lack of availability of customized savings cum credit products that can adequately meet the financial requirements and circumstances of the unbanked or new-to-bank population. It also presents a strong case for a business opportunity for formal financial service providers to design a community-based product with features of a chit fund such as flexibility of withdrawal, incentives to save for longer tenures as well ability to covert flow to lumpsum in a short period of time.

Why do you think this product is largely missing in the Indian market and how can we work towards creating such products for the mid-mile and last-mile customers? Let us know your thoughts!