This is part one to a two-part series article.

Setu existed long before its formal inception in 2018—albeit as a nebulous idea in the minds and half-baked jottings of Sahil Kini and Nikhil Kumar. Back then, Sahil was an active IndiaStack volunteer working on the Aadhaar project, and Nikhil was a fellow at iSpirt, tasked with building the developer ecosystem for IndiaStack.

They would cross paths occasionally, before formally being introduced to each other by Nandan Nilekeni. This was at a time when fintech was in its nascent stages, and had not attracted the fancies of investors yet. Nikhil was working on getting startups to build on top of the UPI platform, while Sahil handled the “airgame” of smoothing things out with regulators, investors and enterprises.

These large, nation-scale projects like Aadhaar, GST, UPI and BHIM had shaped the way Sahil and Nikhil perceived the landscape, and they both wanted to work on something that they could call their own. Over the course of endless sessions of ideation and brainstorming they came to realise they both shared the vision of solving for financial inclusion in India. That was the easy part—the what.

Here’s the why—India has a wealth gap of mind-boggling proportions. For example, if you stay in a metro, and have a salaried job, pay taxes, have a car and any of the check more of the “normal” items we all take for granted, you are already in the wealthiest top 5% in India. Nikhil and Sahil wanted to change this—and at scale.

Now for the hard part, the how.

The first iteration of Setu was a product studio—a consultancy built to help fintech start-ups design platforms and digital products. Sahil and Nikhil quickly put together a simple manifesto of sorts, and presented it to Nilekeni, who promptly shot holes in it—the agency/consultancy approach would create no value, have no recurring benefits, and also not scale enough to truly solve for financial inclusion.

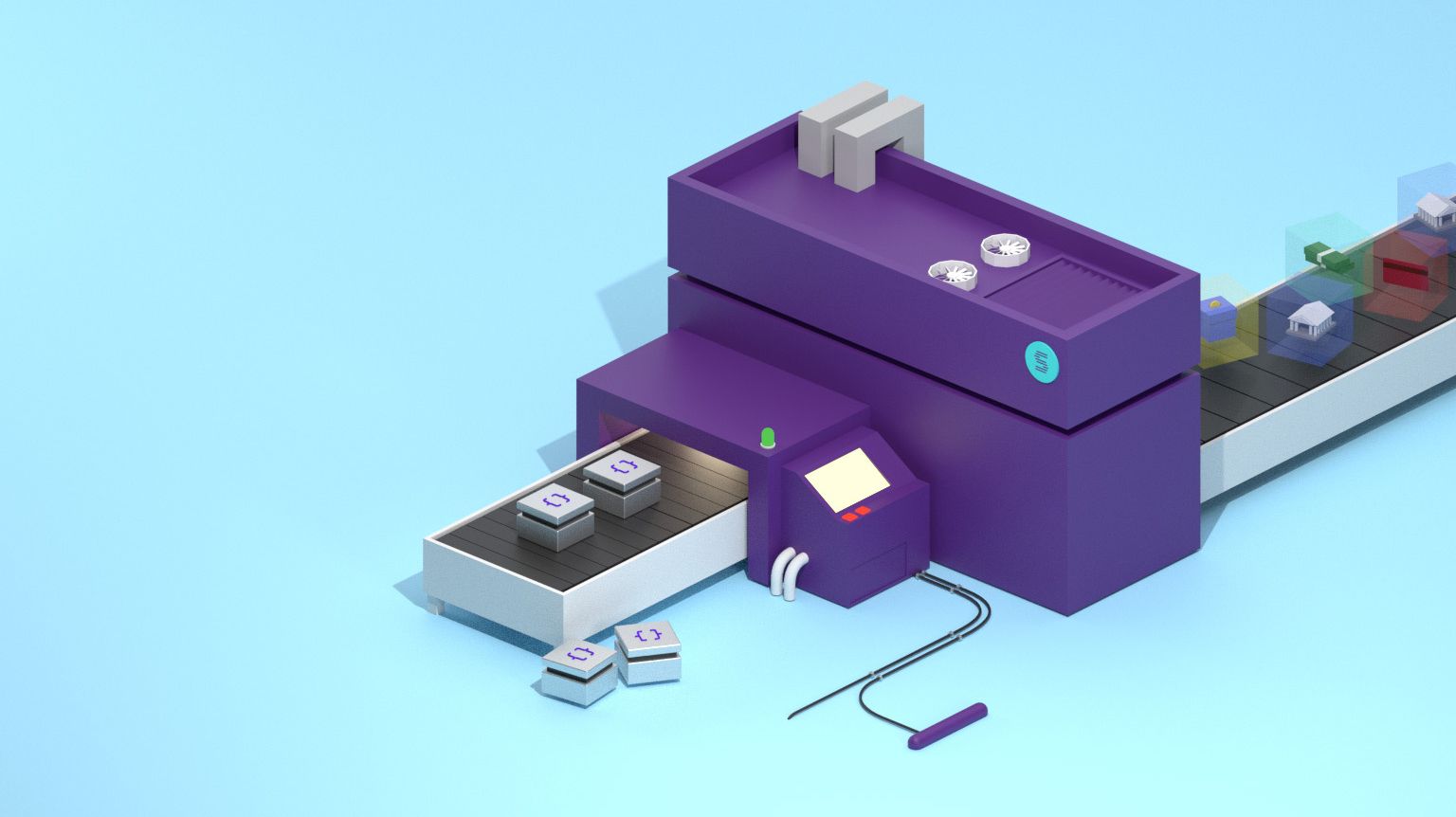

No, this needed to be a platform, that other companies could build on top of. And not just any platform, but an API platform. This is what would truly scale—if we could tap into financial institutions and break their offerings down into their atomic blocks, and expose them as APIs—anyone could now assemble them into products solving for the specific needs of specific cohorts. Just like Lego, providing these blocks was the best way to solve for inclusion—what you can build is limited only by creativity.

This API platform would also make it easy to move money and data between entities. These entities currently exist as isolated islands in the vast, uncharted fintech sea—and have to build one-on-one custom integrations to talk and share data amongst themselves. But now, these islands can all just plug into this singular API platform, and immediately become accessible to every other island in this archipelago.

This is why it makes sense to call this platform Setu, which in Sanskrit means a bridge.

For part two, click here.