The future of microloans—Part I

7 Aug 2021 — D91 LABS — TALES OF BHARAT

(This blog is part 1 of 2 blogs)

India is estimated to have 77 million microfinance borrowers1. Small ticket loans are bringing this customer base, which is larger than the population of Germany, within the fold of formal finance in India. This is orchestrated by a variety of supply-side players - Small Finance Banks, Banks, non-profit lenders, and NBFC-MFIs. In a recent consultative document2, the Reserve Bank of India (RBI) proposed various measures that intend to curb overindebtedness, deregulate pricing of loans, improve loan-related communication for the last-mile borrower and encourage product and process innovation for all regulated entities.

The proposed measures are forward-looking and progressive, yet may be challenging to implement. The recommendations signal a step towards activity-based regulation, rather than entity-based regulation for the microfinance sector3. In this blog, we discuss the features and scope of a standard microloan product and customer as well as undertake a thought exercise to understand the implications of some of the measures proposed by RBI. We also uncover some potential technology use-cases that could help implement these recommendations in a cheaper, faster, and an efficient manner.

Who is a standard MFI customer?#

A typical customer would be a woman who is either a new-to-bank customer or has completed a few loan cycles. These loans are borrowed for a variety of reasons such as business development and expansion, consumption smoothing, emergency financing, or financing for other life-cycle needs. The loan disbursed in the first cycle varies within institutions but is usually in the range of Rs. 30-40,000, with interest rates ranging from 24% to 26% and tenure of 18-24 months. Once the loan is repaid as per the schedule, the customers are graduated to the next cycle. Typically SFBs and NBFC-MFIs offer 3-4 rounds of credit post which the customer is graduated to avail a personal loan or microenterprise loan.

Summary of proposed changes:#

The primary intent of the proposed changes is to place all institutions extending micro-loans on equal footing. This is a departure from current regulation, wherein NBFC-MFIs have interest caps and other limits placed on the loans they provide. Apart from the removal of the interest rate cap, all proposals are applicable for all regulated entities

Here’s a snapshot of the key changes that would most impact the way microfinance lenders operate:

1. Board-approved policy to determine ‘household income’

1. Board-approved policy to determine ‘household income’

The proposal notes the present difficulty in assessing individual income for an MFI borrower, particularly given that a majority are women, who may not have significant standalone income, and the cash-intensive nature of the sector.

This also means repayments of microloans are made out of the collective incomes in a household, and any overindebtedness must be stress-tested against this household income. A key recommendation is for all regulated entities engaged in microfinance to arrive at their own household income assessment methods, based on cash flows, spending patterns, peer group incomes, or others, thereby leaving the door open for each organisation to develop their own innovative client profiling methods.

2. Removal of interest cap

NBFC-MFIs currently need to ensure that the interest rates they charge are capped at 10 or 12% (depending on the size of their loan book) over and above their cost of funds. In practice, this keeps the interest rate across MFIs at 24-26%. They are also required to cap their loan processing fee at 1% of the total loan amount.

The new proposal removes this interest rate and processing fee cap, and leaves it to the Board of each MFI to decide what their interest and fee model should be.

3. The household indebtedness threshold

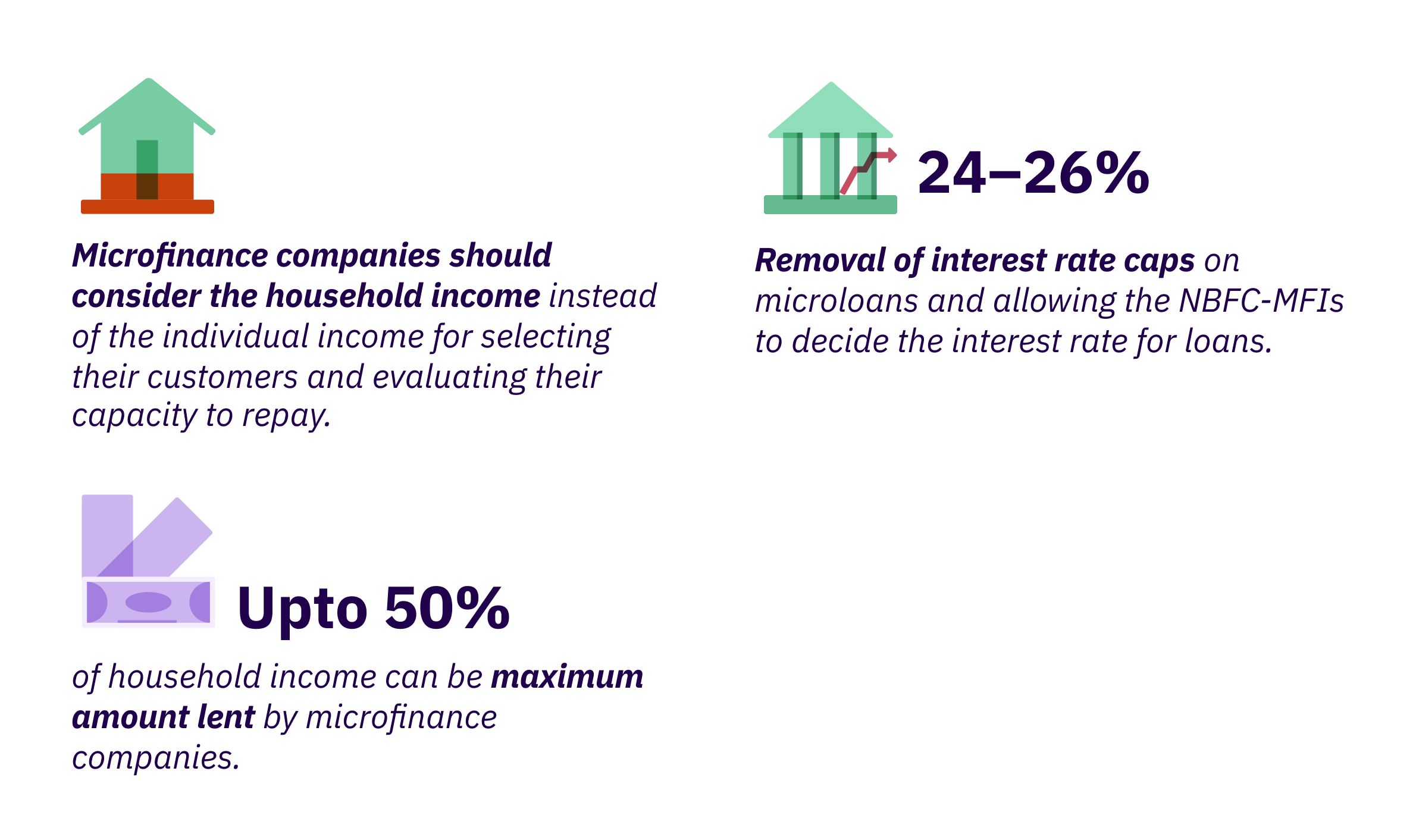

Current regulations place absolute number caps on first-cycle and second-cycle loans of borrowers, and the overall indebtedness that a single borrower can incur. These caps do not factor in the effect of the loan and its repayment obligations on the borrower’s household.

The new proposal links the total permissible loan amount to the income of the household and states that any entity providing microloans must have a Board-approved policy earmarking the maximum debt-income ratio it will check its prospective borrowers against. This is however subject to a maximum cap of 50%, to ensure low-income households save at least half their income towards meeting their expenses. The household income threshold for the urban and rural customers remain ₹1,25,000 and ₹2,00,000 for rural and urban/semi-urban households respectively.

4. Flexibility of repayments

NBFC-MFIs currently allow their borrowers flexibility in choosing their repayment schedules. The recommendations envisage extending the same flexibility for microfinance customers of banks and NBFCs as well.

The rationale behind proposed measures#

The rationale underpinning the removal of the interest rate cap is that this will incentivize NBFC-MFIs to expand their operations among underserved markets, regions with low credit penetrations, and other untapped markets. It will allow MFIs to innovate products and price their loans according to the service regions, the risk profile of customers, and modes of transactions. For instance, to explore hitherto underserved markets: these could be geographies that are perceived as having high costs to operate in or those with low Debt-GDP ratios, or such as AP and Telangana, where microloans may warrant a higher risk premium. It will also be possible for NBFC-MFI to offer risk-based pricing for customers with checkered credit repayment history.

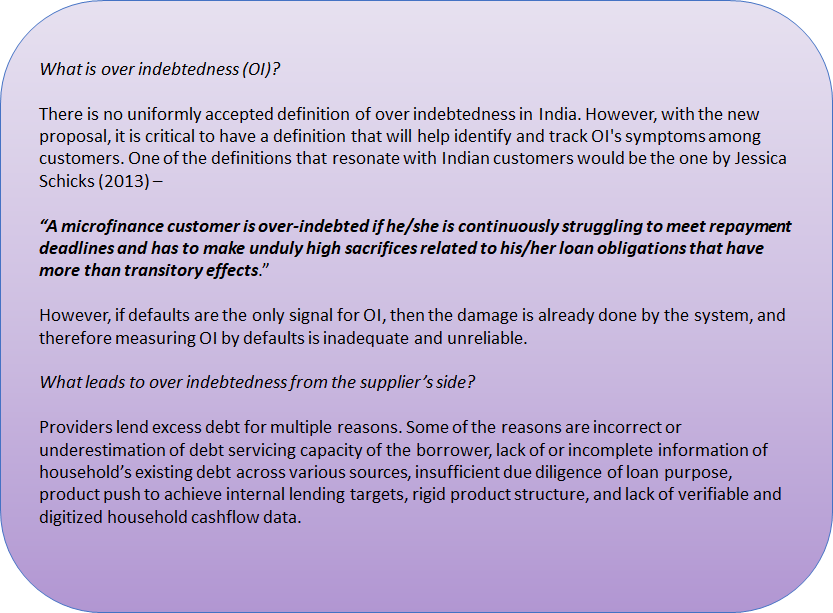

The paper also believes that competition will ensure that MFIs do not charge usurious rates, thus protecting borrower interests. These proposals made by RBI are to avoid the incidence of overindebtedness4 among borrowers.

In part 2 of the blog, we will discuss how fintech can aid the implementation of the RBI proposals. Look out for the next one soon!

Special thanks to Basil Roy for his insightful views.

All illustrations were created by Prajna Nayak.

1 5th edition - Microfinance Pulse Report _ 14.07.2020 (sidbi.in)

2 Link to RBI’s proposal - https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/MICROFINANCE21A930650DE644A2B6DEB55BF03315D6.PDF

3 “Activity-based rules consist of requirements to be met by all institutions offering a given service (eg credit underwriting, payment services, investment intermediation, investment advice). Entity based rules consist of requirements imposed on institutions with a specific licence or charter. That charter is defined in terms of the activities those entities are allowed to perform.” - Report by Bank of International Settlements

4 Schicks, J. (2013). The definition and causes of microfinance over-indebtedness: a customer protection point of view. Oxford development studies.