Reliability: The Quiet Revolution That Defined Setu’s 2025

19 Jan 2026

Every morning, millions of tiny things just… happen.

A metro gate opens. A bill gets paid in seconds. A verification checks out smoothly.

No fanfare, no friction — just the quiet rhythm of a country moving.

There’s a kind of elegance in technology you don’t have to think about. When the tap happens instantly, the bill pays smoothly, the verification clears in seconds — that’s when infrastructure is at its best.

In 2025, we leaned into that elegance. Not with big slogans or complicated promises, but with consistent, meaningful improvements that made life easier for millions.

Small shifts, steady changes, and a few bold leaps turned everyday journeys into effortless ones.

Here’s the story of those upgrades.

1. When reliability becomes a commitment — not a wish#

Every fintech knows that late-night call:

“Success rates look off. Can you check?”

Even when it’s not your fault, it is your problem.

So we decided to eliminate the uncertainty altogether.

In 2025, Setu introduced something the ecosystem had never seen before: a UPI Performance Guarantee.

Not “best effort.” Not “we’re monitoring.”

A real, contractual guarantee:

If we don’t meet the SLAs, we pay our commission back.

This wasn’t swagger — it was engineering maturity.

To learn more about the UPI Performance Guarantee and its related features, read our detailed blog here .

Our stack made massive leaps:

- India’s first Single Block Multi-Debit with NPCI

- Stronger performance controls

- Faster dispute resolution

- A real-world dispute agent dashboard

For businesses like FanCode, where scale is critical, this wasn’t a product update —

It was reliability that finally showed up with accountability.

2. Verification that doesn’t wobble — even when the ecosystem does#

Identity is where trust begins — and historically, where reliability fell apart.

Multiple APIs. Unpredictable uptime. That anxious “What if this fails right now?” feeling.

In 2025, we rebuilt this foundation.

Setu Switchboard, India’s first data verification router, became the single control point for identity flows.

We launched Aadhaar-based verification with UIDAI — a first for any TSP.

And Bundled Bank Verification turned four fragile methods into one dependable API.

For businesses, verifying a customer across multiple rails in seconds isn’t a feature.

It’s engineered reliability that removes friction from the journey.

To understand how this product works and the features behind it, read the full product blog here .

3. Intelligence that shows up before things break#

Data is everywhere.

Reliable insight isn’t.

This year, we built tools that helped partners shift from reactive firefighting to proactive clarity.

Finsights, powered by Pine Labs’ payments graph, turned raw data into enriched risk signals.

For customers, it reduced blind spots and improved evaluation accuracy.

To learn more about the product and its features, read the full product blog here .

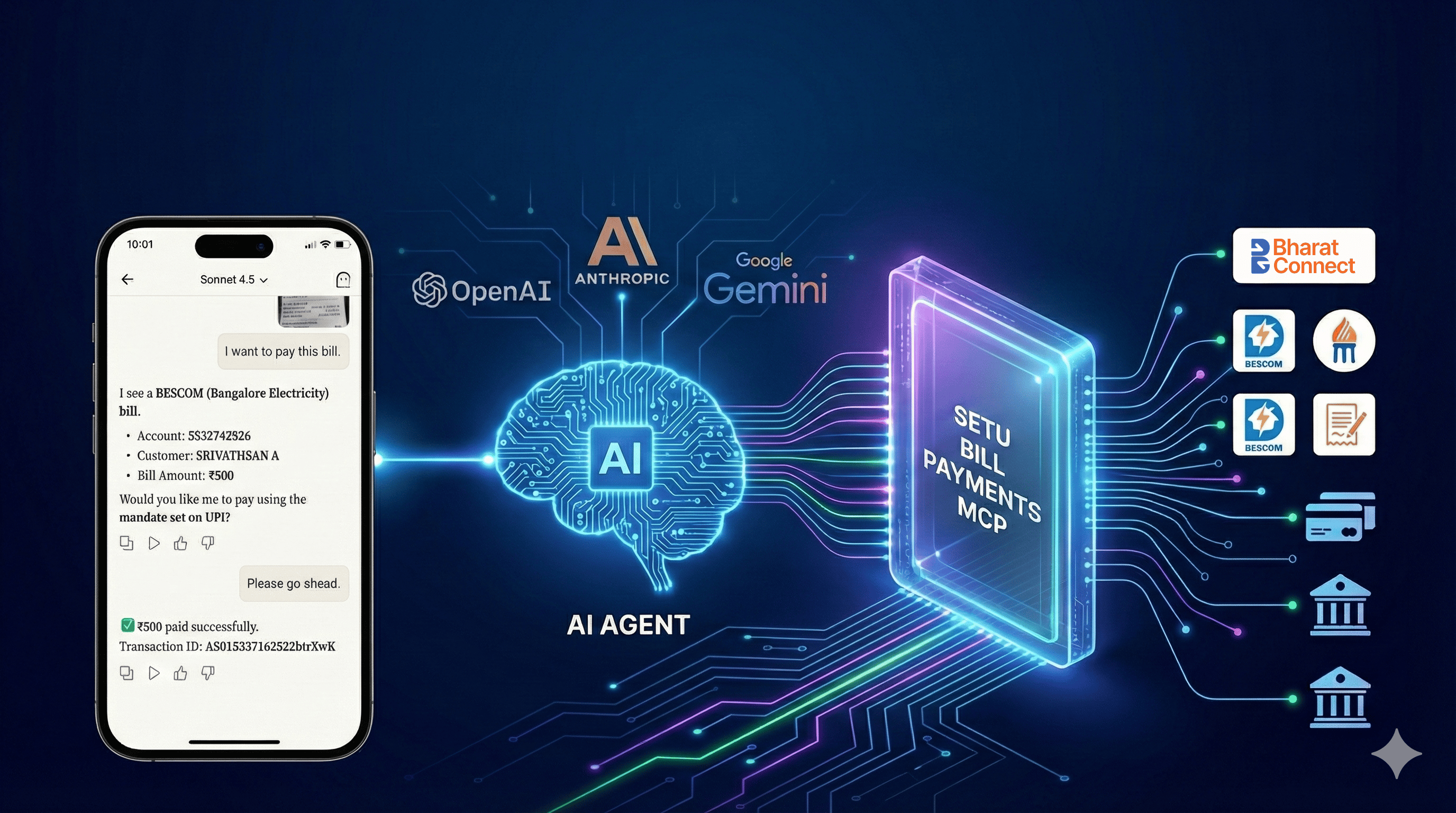

And then came a country-first:

Agentic Bill Payments — autonomous bill settlement backed by BBPS and AI reasoning.

FX retail payments on BBPS.

Intelligent triggers that prevent failure before it happens.

To learn more about the product and its features, read the full blog here .

When CRED showcased this partnership in a full-page Times of India feature, it underscored a simple truth:

Reliability is no longer about speed — it’s about systems that think ahead.

4. When reliability earns recognition#

Some milestones matter because they validate the direction you’ve taken.

Hosting the Hon’ble Finance Minister Smt. Nirmala Sitharaman at our office — where we demonstrated the real impact of our digital public infrastructure work — was one such moment.

Being awarded NPCI’s Ecosystem Catalyst at their first TSP Awards was another.

But the milestone that will stay with all of us:

Pine Labs listing on the Bombay Stock Exchange.

A public listing isn’t just a corporate leap —

It’s a signal that the infrastructure powering millions of lives is now part of India’s formal, regulated, national fabric.

The Road to 2026: Reliability becomes the standard everyone builds on#

If 2025 had a message, it was this:

The next decade of fintech won’t be about being fast.

It will be about being unfailingly reliable.

Setu’s role is only getting sharper.

As Pine Labs enters its new public chapter, we’re building digital infrastructure that Indian businesses can trust without hesitation.

We’ve moved beyond connectivity.

We’re shaping a system where reliability isn’t a promise —

It’s built, measured, guaranteed, and felt.

Because the future of digital India isn’t about what works.

It’s about what always does.