Moneyboxx’s 15% Reduction in Cash Collections with BBPS

29 Jan 2024 — CUSTOMER STORIES

Customers in rural area who are still not part of an organised financial system need credit to fulfil their unmet credit demands. However most of the time, they are kept outside financial walls due to lack of credit scores, digital footprint and several other factors. Moneyboxx plays a crucial role in bridging this gap by extending credit to cattle farmers, small and medium-sized enterprises (SMEs), as well as proprietors of kirana shops in tier 3 cities and beyond.

With a wide network of 94 branches across 6 states, Moneyboxx not only provides financial assistance but also provides ancillary services like veterinary doctors for cattle, training sessions, frequent branch visits and monthly camps.

Yet, the challenges of collecting EMIs back from this customers loomed large.

45% of EMI payments were cash transactions, and this posed the risk of embezzlement. Moneyboxx needed a solution that could centralise their collections, reduce risks of cash handling, and enhance the overall efficiency of their operations.

Enter Setu.

Setu’s BBPS BOU transformed the landscape of EMI collections for Moneyboxx.

A quick primer on What on earth is BBPS?

With a quick integration process that was completed in under two weeks, Moneyboxx went live on all popular UPI apps, resulting in an impressive collection of ₹2 crores in the very first month. The subsequent months saw a 15% reduction in their cash collections, as Moneyboxx leaned towards digital EMI collection channels.

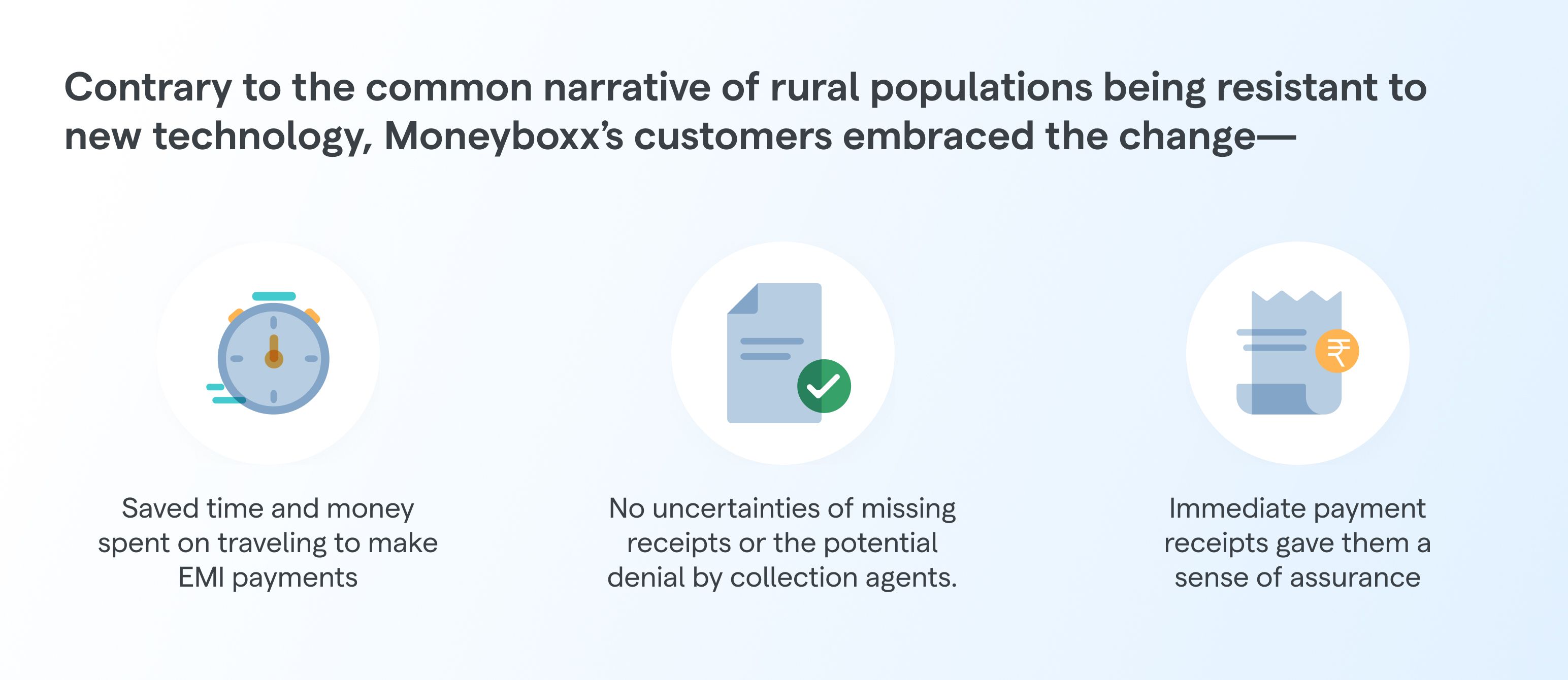

But what sets Moneyboxx’s integration apart is not just the numbers. In rural areas, where scepticism towards technology, especially when it involves money, is a prevailing sentiment, Moneyboxx witnessed a different story. Unlike the common narrative of rural populations being resistant to new technology, Moneyboxx’s customers embraced the change.

Borrowers from Tier 1 and Tier 2 cities, often accustomed to the traditional modes of repayment, found all the positives in this switch. They no longer had to travel long distances, spending valuable time and money to make simple EMI payments. The immediate payment receipts from BBPS provided a sense of assurance, a tangible acknowledgement of their EMI payment.

This is important since, in cash transactions, where a mere denial of a receipt could plunge individuals into challenging situations and financial losses, trust plays a crucial role.

Moneyboxx’s customers no longer had to grapple with the uncertainties of missing receipts or the potential denial by collection agents.

Beyond the impressive numbers and operational efficiency, the true essence of this collaboration lies in the hearts of the rural communities it serves. Moneyboxx, propelled by Setu’s BBPS BOU, not only increased their digital EMI collections but also shattered the prevailing skepticism towards technology in rural areas.

Intrigued by the transformative impact of BBPS BOU? Get in touch with us here.

Explore the remarkable success story of Annapurna Finance's integration with Setu's BBPS. Over the past 12 months, their loan repayments through BBPS have surged by an astounding 12X!