How do digital lending companies collect? Here are the top five collection channels

8 Feb 2023 — PRODUCT

”There are no lending companies, only collection companies.”

This is an age-old joke in the lending space. We know that credit is highly-sought after—technology has made it easy for lenders to on-board, verify, underwrite and disburse credit. But, recovering credit is still a challenge. If a lending institution has a high number of defaults, the resulting bad loans or NPAs (Non-Performing Assets) adversely impacts their profitability. This is also why we would argue that collection may be more important than any other step in a lending lifecycle.

While advancements in the collection space have been pale compared to other areas of lending, various initiatives have been taken to assist lenders in reducing NPAs. One such step is the setting up credit information bureaus in 2000. These bureaus provide rich financial information to lenders and help them to prevent loans falling into bad hands and therefore help reduce NPAs. They also help banks by maintaining and sharing data of individual and willful defaulters.

For a lender, it is prudent to have multiple—and diverse—collection channels for borrowers to easily repay loans. Here are the best five collection channels for digital lending institutions.

1.eMandate and eNACH

eMandate and eNACH are two different services but they both deliver the same result—collecting automated recurring payments. They are used by several lending institutions to directly deduct the EMI amount from their borrower’s bank account. To authorise these recurring payments, a customer submits a digital form to automatically debit a certain amount from their account at set intervals.

eNACH is governed by NPCI and covers 40+ banks while eMandates are controlled by individual banks and are currently available across 4–5 banks. Both eMandate and eNACH are “pull” payments that require no customer intervention once set up, and are a favourite amongst lending institutions.

The two services are similar to a standing instruction to your bank to deduct a fixed amount on a particular date. However, the current bank coverage is limited. Also, since the registration process for these two services requires high-effort action by a user—entering netbanking credentials or debit card details—the drop-offs while setting up are very high.

2.BBPS

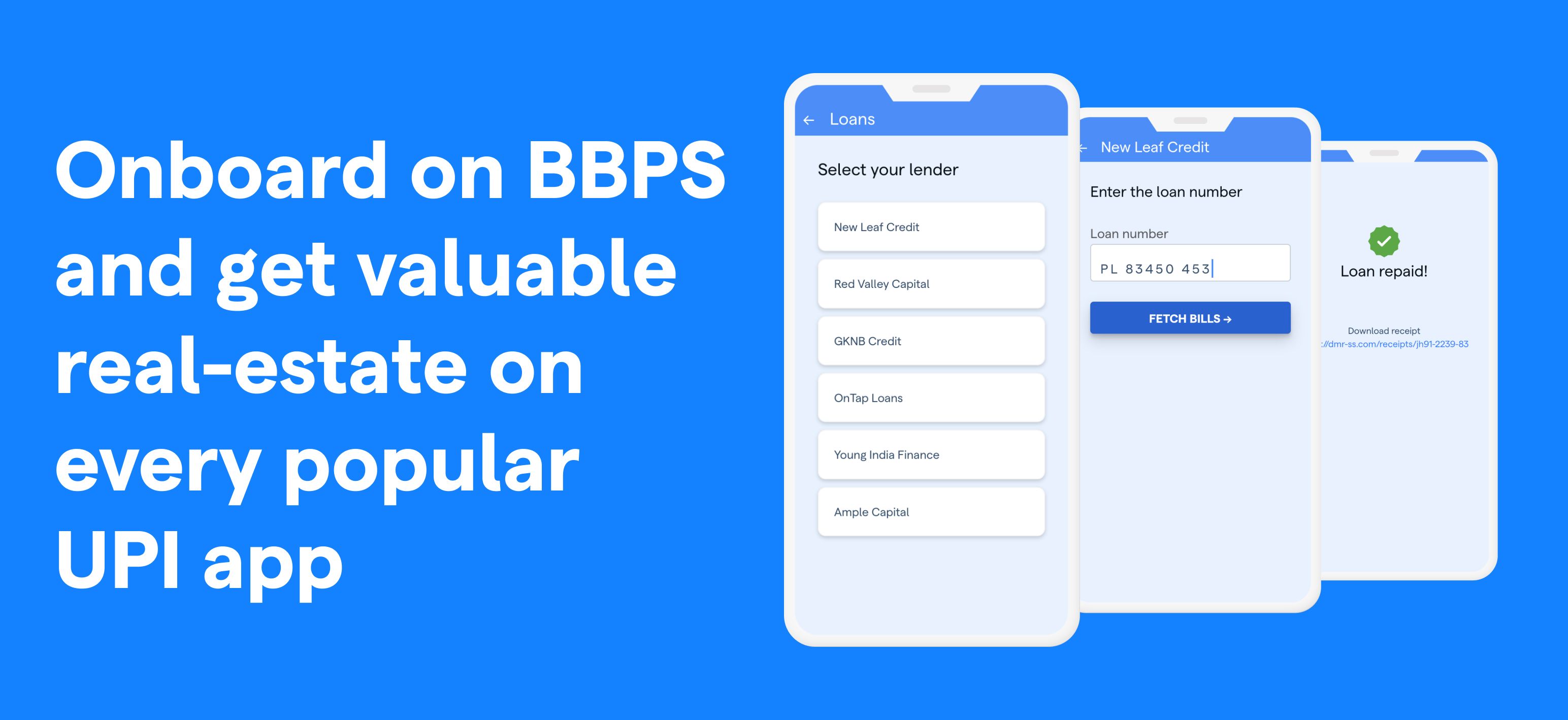

BBPS or the Bharat Bill Payment System is one of the fastest growing methods to collect recurring payments like loan EMIs.

BBPS is an interoperable system that lets businesses become available across all payment apps by just getting on-boarded once on to this ecosystem. And with digital payment options enabled on these apps, a customer can make payments from anywhere, anytime. The BBPS setup is backed by RBI, assuring all parties of its reliability.

On-boarding a lending institution on BBPS enables them to be discoverable across multiple payment apps like GPay, PhonePe and PayTM. Users can open up any BBPS-enabled payment app, find their lender and make direct payments. All this, without having to visit the lender’s app or website. Loan repayments on BBPS have seen remarkable double-digit growth over the past few years and all the largest lending institutions in the country are signing up to get valuable real-estate on these payment apps.

Check out how Ujjivan Small Finance Bank digitised their collections with Setu’s BBPS APIs.

3.Payment gateways

Payment gateways (PGs) are a popular channel of collection by lending institutions. Once a lender integrates a payment gateway on their app or website, borrowers can use any of the several payment options to repay their loans. PGs helps the lender in controlling the end-to-end payment experience for their borrowers. They also provide powerful insights that help lenders understand repayment patterns of their borrowers.

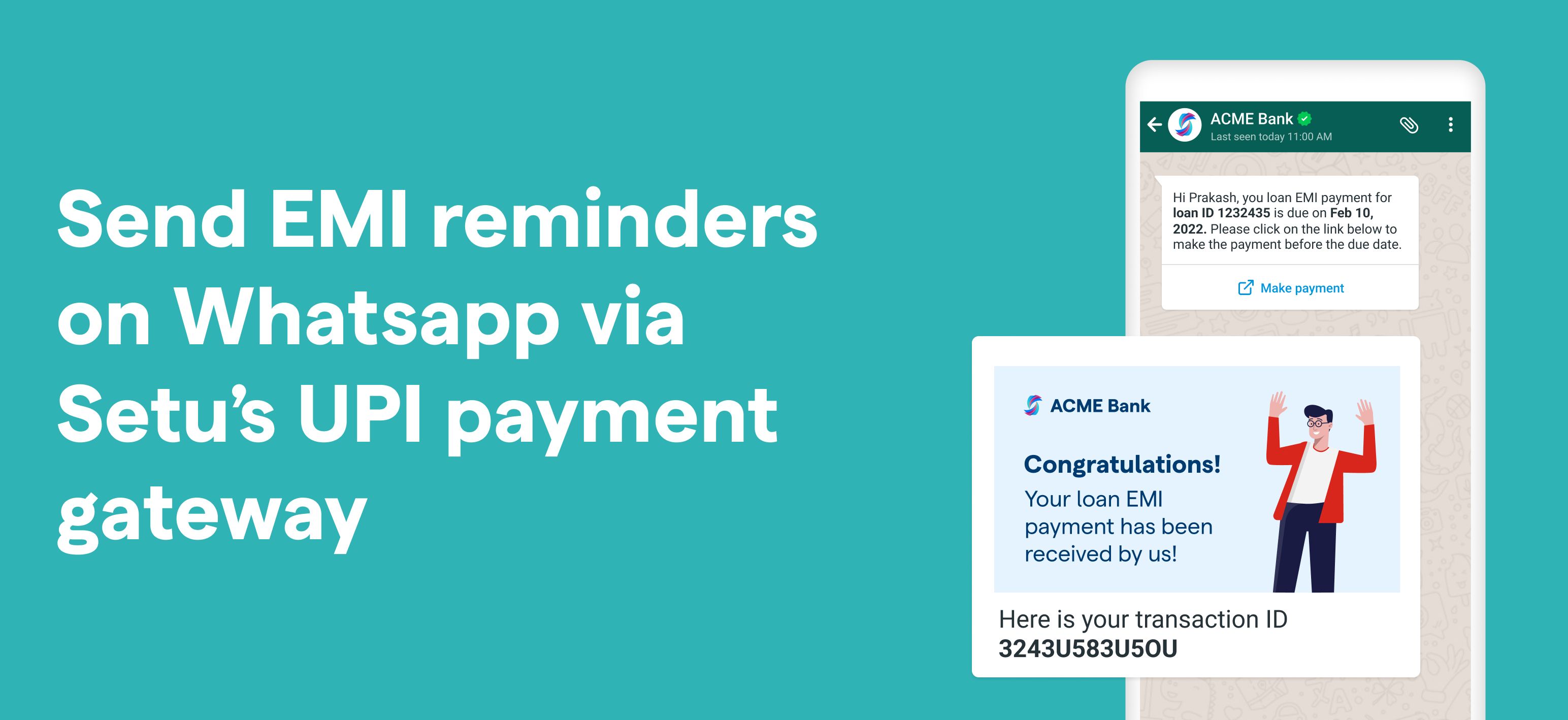

Payment gateways also offer links which can also be sent via SMS, email, or WhatsApp to delinquent borrowers for reminders. A lender can create a payment gateway link with a preset amount and send it to borrowers as loan repayment reminders.

Also, using Setu’s UPI, you can build a WhatsApp-based one-click EMI reminder bot to facilitate loan repayments with ease. Learn more.

4.UPI mandates

The newest kid on the block—UPI mandates are similar to eMandate but on an UPI app rather than a netbanking screen. The other difference is that unlike eMandate, where the maximum transaction limit is ₹1,00,000, UPI Mandate has a limit of only ₹15,000. UPI mandates are for situations where money is to be transferred later, however the commitment towards that is to be done upfront, such as loan EMIs. Instead of entering your 16-digit debit card number or logging in to a clunky netbanking portal, UPI mandates make it possible for a user to open their UPI app and easily set this up through a few clicks.

It is possible that the borrower may forget to send money later so creating a mandate for a service is prudent. The customer’s account shall get debited when the mandate is executed by the merchant. The integration of Single-Block-and-Multiple-Debits (SBMD) within the UPI framework paved the way for UPI mandates. UPI mandates also give the flexibility to cancel a mandate straight from the UPI app. With UPI’s exponential growth, we predict that UPI mandates will soon become one of the most popular collection methods.

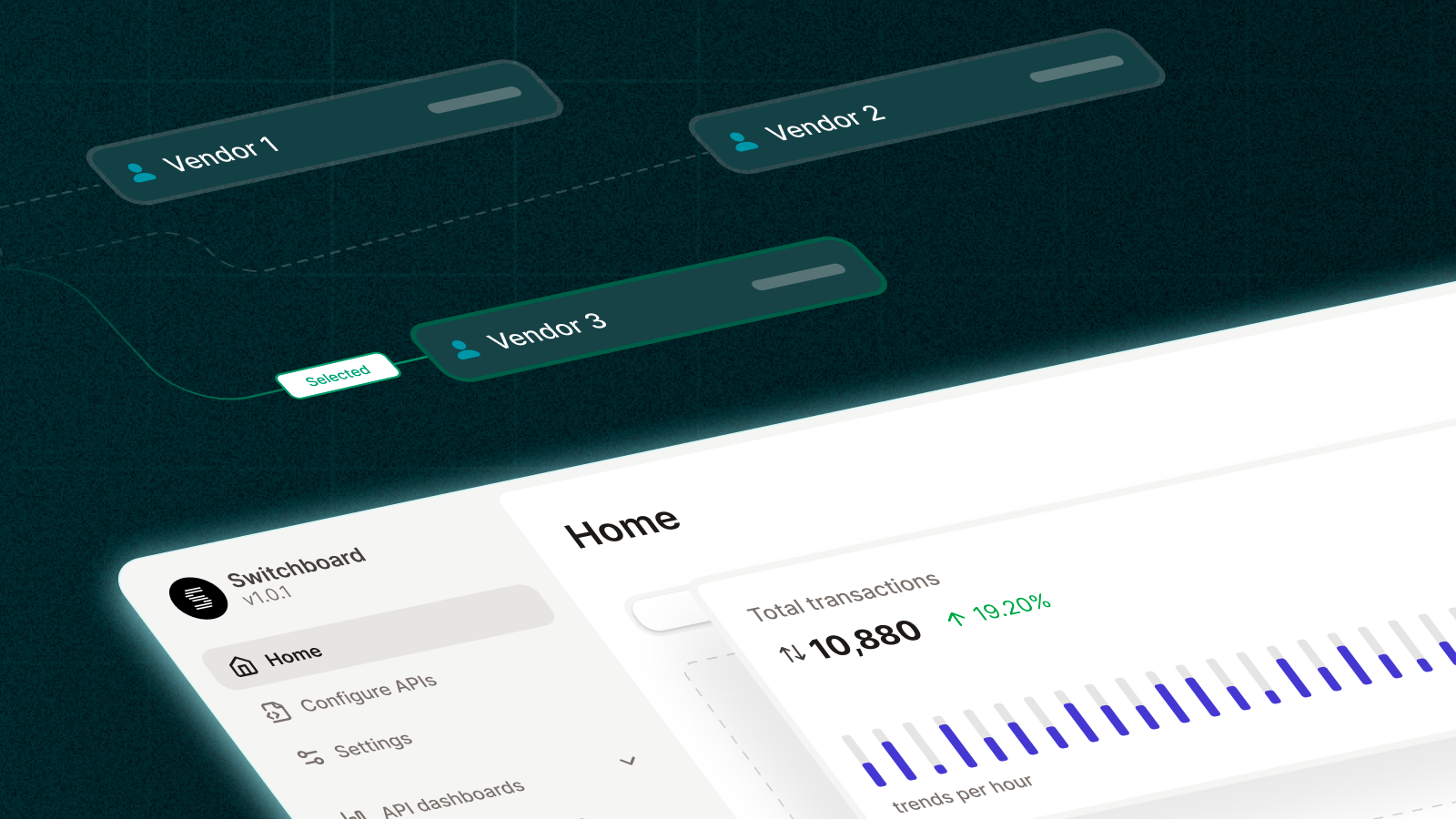

Setu is building a UPI Switch with APIs, SDKs & Apps to enable different cohorts of customers to integrate new features. This will help merchants launch features on UPI like Autopay, eVoucher, Signed Intent and several others, with the best uptimes in the industry. Sign up here to be a part of the waitlist.

5.Collection tech-startups

Collection tech startups are a new breed of companies that are revolutionising the way lending institutions collect loan repayments from borrowers. These startups offer a range of innovative solutions such as automated IVR calls, SMS reminders, and other methods to help lenders streamline the loan collection process. With the increasing demand for digitisation, collection tech startups are becoming increasingly popular as they offer effective loan collection solutions and reduce the burden on lenders.

Some even use artificial intelligence and machine learning to automate the collection process, reducing the workload for lenders and improving the overall customer experience. Since lenders provide a wide range of loans like personal, home, automobile and others, these startups offer customisable solutions that can be tailored to the specific needs of different lenders.

Collection tech startups are becoming an invaluable resource for lending institutions looking to improve their loan collection processes and stay ahead of the curve in an ever-changing digital landscape.

In conclusion, the collection process is a super critical aspect of the lending cycle and has been made easier with advancements in technology. Lenders can choose from a variety of collection channels, like eMandates, BBPS, payment gateways, and UPI mandates, to streamline the repayment process for borrowers. Having multiple collection channels not only helps lenders reduce NPAs and maintain profitability but also provides convenient options for borrowers to easily repay their loans.

Setu is an API Infrastructure company and a wholly owned subsidiary of Pine Labs. Setu builds APIs that can be used by lending institutions to build powerful onboarding, underwriting and collections journeys. Sign up here to get started.