What on Earth is an 'FLDG'?

18 Jul 2023 — PRODUCT

Introduction

Riya is an enterprising homemaker who wants to set up a small bakery unit in her house. She needs to buy some basic kitchen appliances to set up her home enterprise - but these are not cheap! Riya had previously worked in a call center and is comfortable with using technology and basic banking services. However, having not worked for some time and with a limited financial footprint, she is what financial institution would call a ‘thin file’ customer.

She approaches several banks in her quest for a loan, armed with all the necessary documents. However, to her dismay, she faced rejection after rejection. The banks cited stringent eligibility criteria, long processing times, and the lack of credit history as reasons for denying her loan application. Riya felt disheartened and began to lose hope.

Enter, fintech

It was during this time that she stumbled upon a fintech company called "Loans ASAP”. Intrigued by their claim to provide hassle-free personal loans, she decided to give it a shot. She visited their app and discovered that Loans ASAP utilized innovative technology to assess creditworthiness and provide loans to individuals like her who were overlooked by traditional banks. Riya found the loan application process on Loans ASAP's app to be incredibly simple and user-friendly. The app also had an option to link her bank account, enabling Loans ASAP to analyze her financial history and repayment capacity. To her surprise, Riya received an approval notification later that day, and the loan amount was quickly disbursed to her bank account.

Riya's experience is not an isolated one. Despite recent improvements, credit penetration for several customer segments remains abysmally poor. Fintechs are increasingly able to service these cohorts that are traditionally deemed ‘risky’ for the following reasons. First, they leverage technology to analyze alternative data points and assess creditworthiness more accurately, going beyond the traditional credit score. Second, fintech platforms like Loans ASAP have streamlined processes and reduced the need for extensive paperwork and lengthy verification processes. Third, fintech companies have a more customer-centric approach. They understand the evolving needs and aspirations of young aspirants like Riya and design loan products that catered specifically to them.

Partnerships with Registered entities (REs) enable fintechs to be able to lend to customers like Riya

The Indian financial sector is proactively regulated by the RBI. This makes fintech partnerships with regulated entities (REs) such as banks very important. Working with regulated financial entities enables fintechs to comply with regulations, gain trust from customers, and leverage established risk management systems. This partnership fosters a conducive environment for lending in India, promoting financial inclusion and innovation while maintaining the necessary checks and balances.

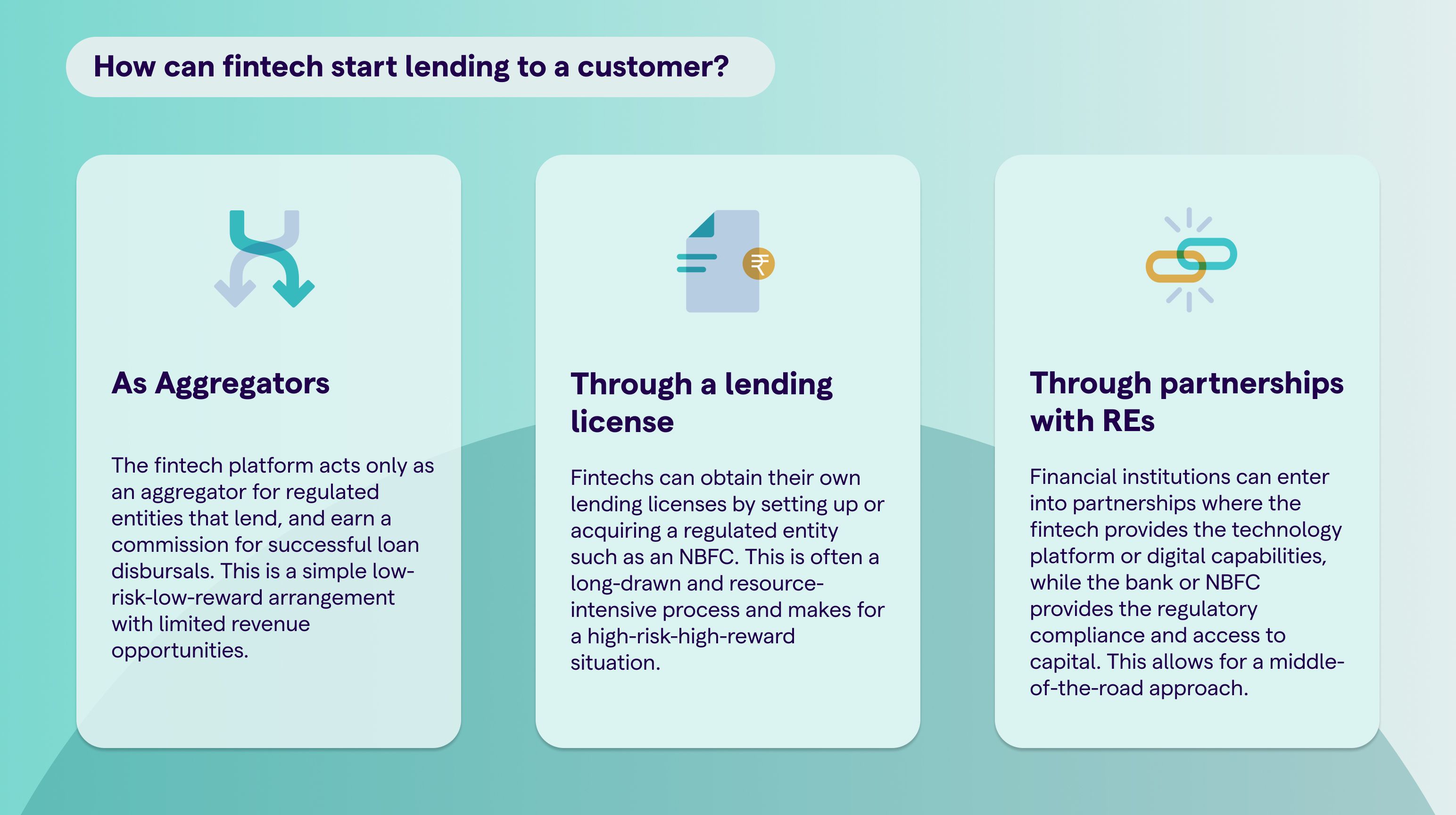

Broadly there are three arrangements through which a fintech can conduct lending operations:

First Loss Default Guarantee (FLDG) is another form of partnership structure between fintech and regulated entities.

So, what on earth is FLDG?

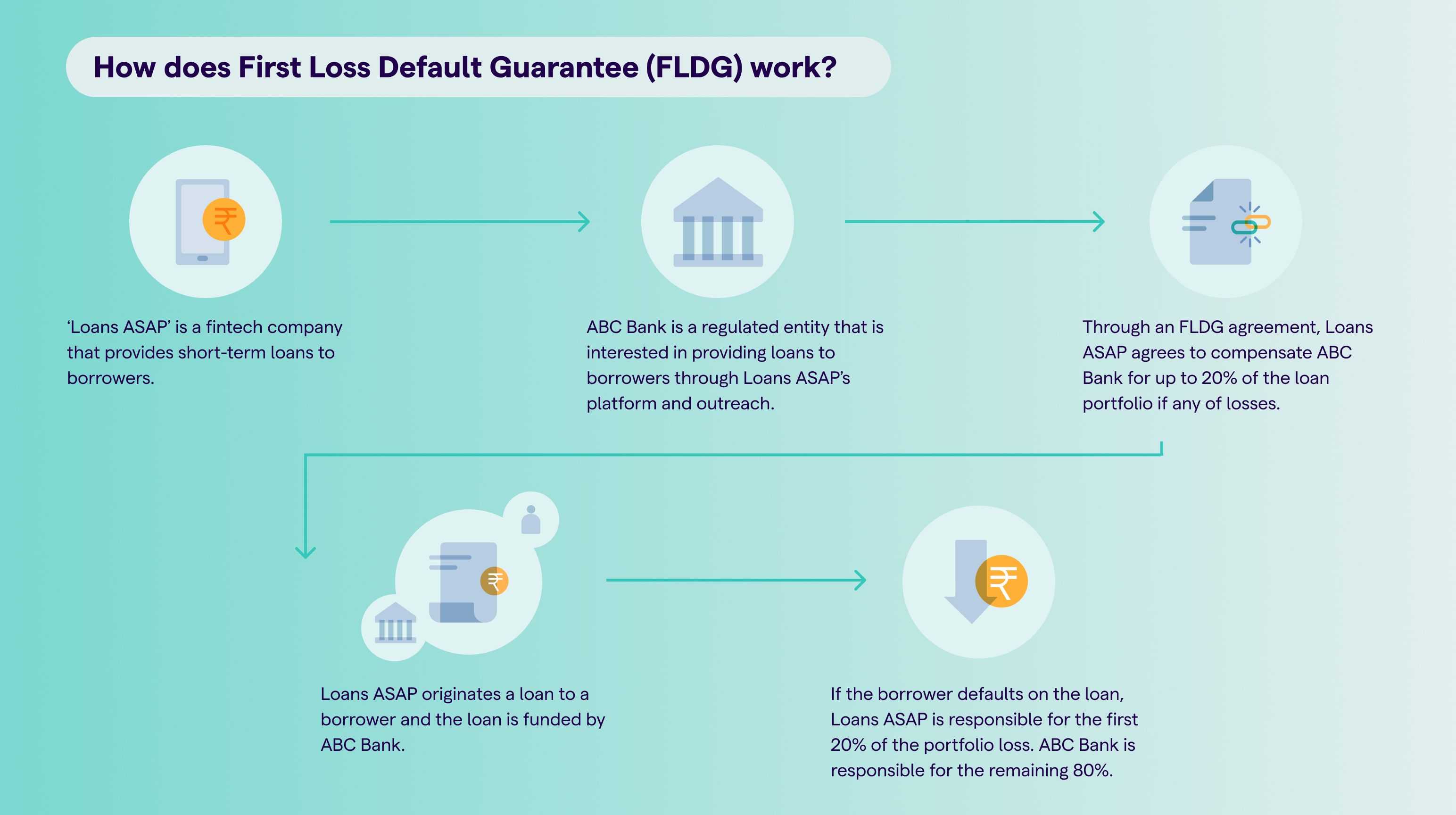

First Loss Default Guarantee (FLDG) is a lending structure between banks or non-banking finance companies (Regulated Entities) and lending service providers (such as fintechs). In an FLDG arrangement, the initial hit on a bad loan portfolio is taken by the fintech firm that originated the loan. The fintech compensates lenders if the borrower defaults up to a certain threshold of the loan portfolio.

Here's how an FLDG works

An FLDG structure provides several benefits to both Loans ASAP and ABC Bank. For Loans ASAP, the FLDG arrangement allows it to originate more loans without having to maintain higher capital adequacy. For ABC Bank, the FLDG arrangement allows it to partner with Loans ASAP to reach a wider range of borrowers. This is because Loans ASAP has a deep understanding of the digital lending market, greater distribution, and can identify borrowers who are likely to repay their loans.

The FLDG arrangement seemed like a win-win for both Loans ASAP and ABC Bank. It allowed Loans ASAP to originate more loans and ABC Bank to reach a wider range of borrowers. The total lending volume in India doubled between 2017 and 2021. However, the proliferation of the FLDG model among other factors meant that total digital lending grew twelve-fold over the same period.

Much ado about FLDG? Enter RBI.

In practice, several FLDG arrangements were made for losses up to 20-25% of loan portfolios. Some even reach as high as guaranteeing the entire portfolio. This meant that unregulated entities could practically carry out lending operations with minimal interference.

Taking note of these developments from the lens of consumer protection as well as systemic risks from enabling unregulated entities to carry out lending activities, the RBI took a very cautionary view of the FLDG model. In Nov 2021, the RBI Working Group on digital lending including lending through online platforms and mobile apps recommended that FLDG arrangements be prohibited in the digital lending market due to concerns about moral hazard, regulatory arbitrage, and consumer harm. However, the recommendation was met with mixed reactions from the industry, with some stakeholders supporting it and others opposing it. FLDG arrangements continued within this ambiguity.

The Digital Lending Guidelines in August 2022 broadly accepted the recommendations of the working committee. The RBI stated that it is examining the FLDG structure and suggested that any regulated entity entering into such an agreement should follow the securitization norms issued in September 2021 until the RBI provides further guidance.

The Reserve Bank of India (RBI) compared the FLDG structure to ‘synthetic securitization’ because they are both financial instruments that are used to transfer risk. In synthetic securitization, the risk of a pool of loans is transferred to investors through the use of credit derivatives. Think back to the infamous ‘Credit Default Swaps’! In an FLDG arrangement, the risk of a pool of loans is transferred to fintech through the use of a guarantee.

This created further confusion in the fintech sector, with lenders (such as banks and NBFCs) mostly ceasing FLDG arrangements. Without commitment towards loan loss, regulated entities were hesitant to lend through fintech and hence the industry clamoured for more clarity on FLDG arrangements.

Latest developments in the field of FLDG

By now we understand that FLDG is a popular and useful tool to build meaningful business partnerships between Regulated entities (banks) and Lending Service Providers (fintech institutions). While the loans are on the books of the banks, the underwriting, distribution, and customer acquisition are greatly facilitated by the fintech. FLDG helps the NBFCs (Fintechs) and banks to cover any potential risks that may occur due to customer default on loan repayments.

After a year of radio silence since implementing a ban on FLDG arrangements between fintechs and the banks, in June 2023 RBI announced a renewed approval for FLDG but with a condition. The First Loss Default Guarantee is now capped at 5%. This means that if the loan portfolio at an aggregate level is 10 lakh, then the fintech can only provide cover of Rs. 50,000 in case of a default. This significantly reduced the fintech’s skin in the game and also limits the opportunity to lend to people with limited credit history.

In the previous scheme of things, Fintech would offer to cover 10-25% of losses on the total loan amount. But financial institutions and RBI have been wary of such FLDG arrangements as this enables them to lend to riskier borrowers without much credit history.

In the recent circular, RBI has also mentioned that the FLDG amount must be paid upfront as a bank guarantee, fixed deposit, or cash. This is to avoid any systemic risk that may arise due to the fintech becoming bankrupt or being non-compliant with the FLDG guidelines at a later stage. It is also to avoid the risk of overleverage and concentration.

This is a catch-22 situation from the financial inclusion perspective. On one hand, our credit penetration is abysmally low and on the other hand, a cap on FLDG of 5% restricts the financial institutions from testing the waters with borrowers with low credit histories. A low FLDG also shifts the responsibility of underwriting from the fintech to the banks (or utmost a share responsibility) and therefore fintechs become a source for only customer acquisition and loan distribution.

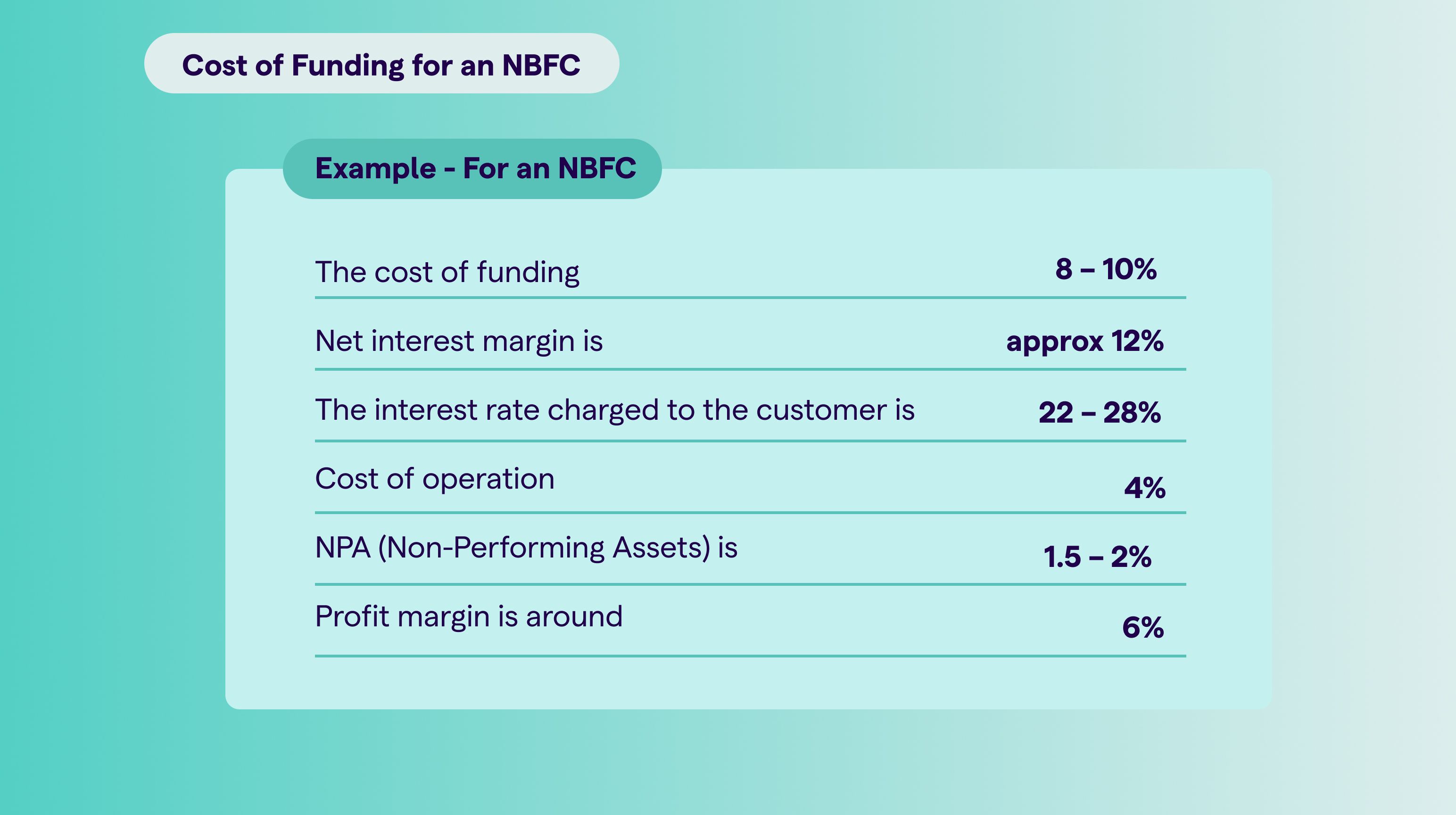

If the NPA is upto 5%, the institution may not face a major loss to it profit margin when lending to new-to-credit customers. However, there are reports of fintechs that faced an NPA of 12% and more and in this case, the FLDG cap would not be enough to cover the losses for the bank. A higher FLDG could also lead to costlier loans for the borrower due to extra fees and charges. At any cost, the Reserve Bank of India does not want to trade off Responsible lending for Financial Inclusion.

Conclusion

Overall, RBI has maintained a conservative view on FLDG but also allowed for partnerships among REs and LSPs that have adequate knowledge of the borrowers, a proven track record of low NPAs at a portfolio level, and competitive advantages at their end. With rising debt traps and fraud, RBI’s prudent action on FLDG reiterates the need for responsible lending particularly for loans generated by digital lenders. It remains to be seen whether with time RBI changes its stance on LSP skin-in-the-game as digital lending expands its business in India as well as fosters innovation.