Reimagining credit in India: Alternative data and the next credit revolution

19 May 2025 — PRODUCT

ACCOUNT AGGREGATOR

My mom hasn’t ever used a credit card - and neither has she had a loan in her name. She worked in a solid government job for 35 years, built a decent nest egg for herself, and always relied on her own savings for all her expenses. She’s been financially responsible, seen the peaks and troughs of the economy, and hasn’t ever defaulted on any bill payment.

Technically, it shouldn’t be too hard for her to get a loan from a traditional lender, right?

Wrong.

For decades, traditional data like credit bureau scores, bank statements, and formal financial histories have been the gatekeepers of credit access in India. But what if you’ve never taken a loan or owned a credit card?

For many Indians-including people like my mom, who has always managed their own expenses like a pro but never borrowed a rupee from a bank, traditional credit data just doesn’t cut it. And she’s far from alone.

The limits of traditional credit data#

The way lenders have been judging creditworthiness is a bit old-school. They look for a history of loans, credit card payments, and other formal financial footprints. But what about the millions who’ve never needed a loan, or who rely on cash for everything?

My mom is a perfect example - people of her generation view credit as the devil - and since she’s never had a loan or a credit card, her credit profile is basically invisible to the system.

And it’s not just folks like my mom.

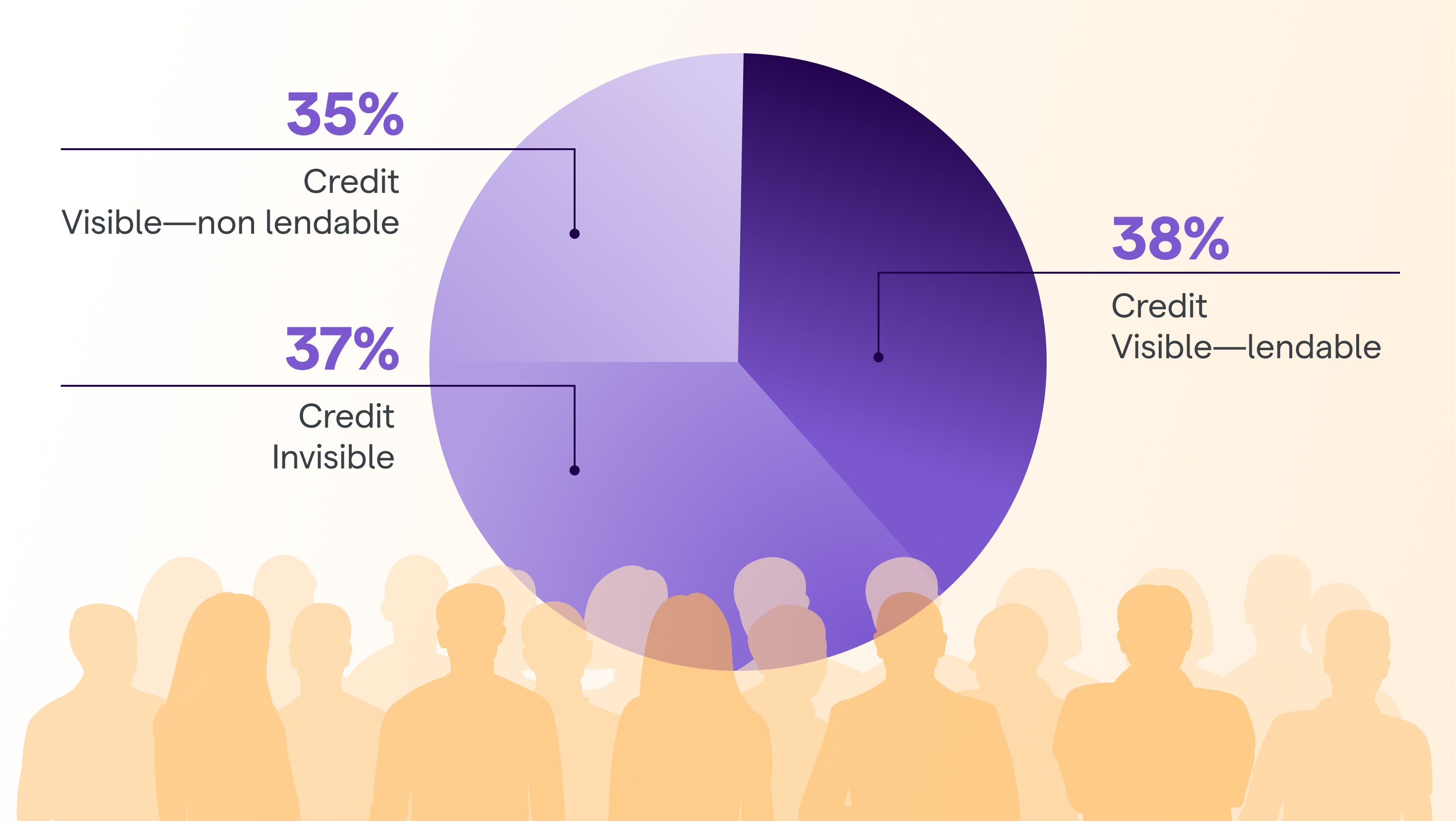

Think about gig workers, kirana store owners, farmers, or even young professionals just starting out. If you don’t have a formal credit history, banks often treat you like you don’t exist. This leaves a huge chunk of India (about 60% of the population) locked out of formal credit. They’re forced to turn to informal lenders, often at sky-high interest rates, just because the system can’t “see” them.

Why alternative data is a game changer#

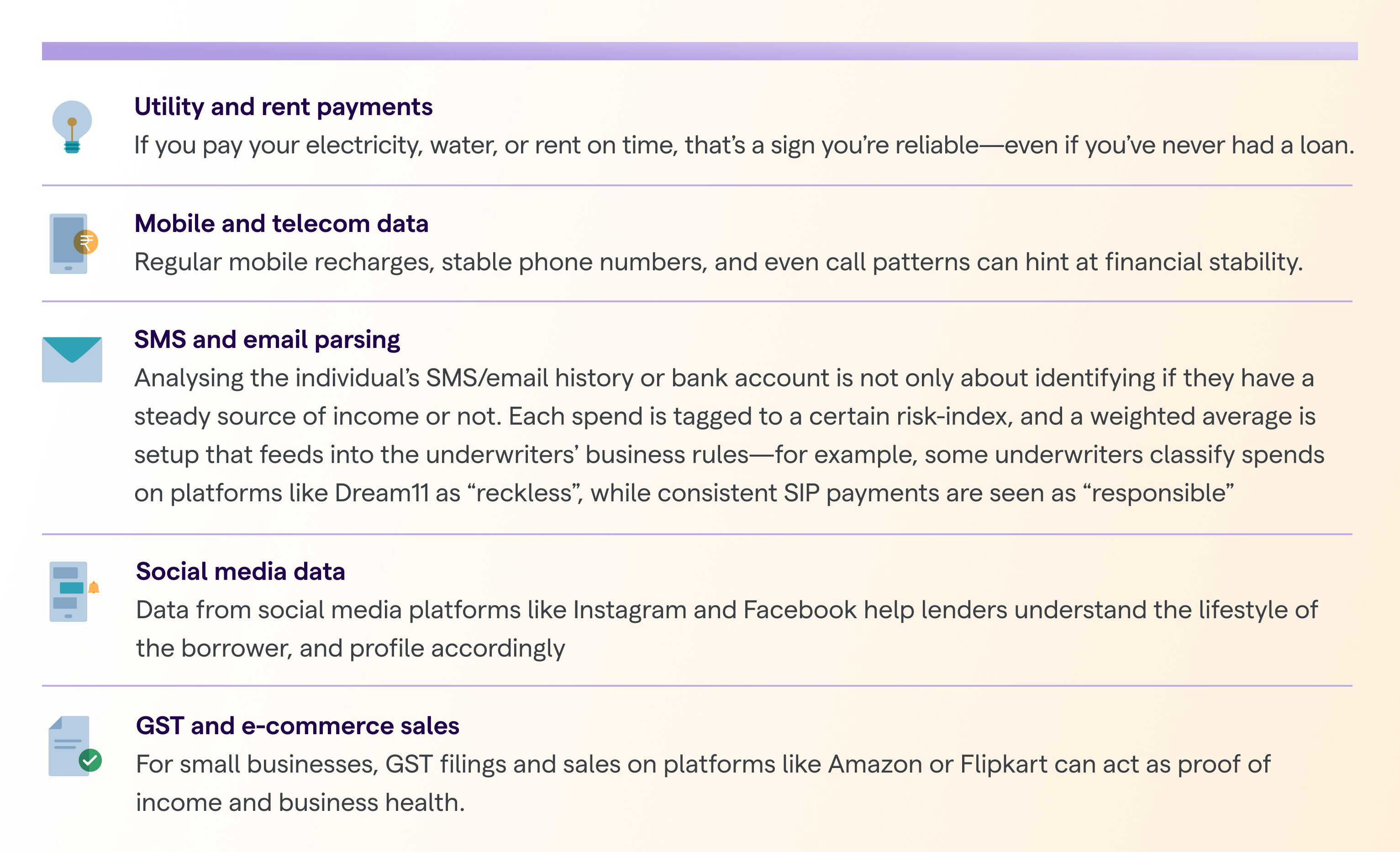

This is where alternative data steps in, and honestly, it feels like a breath of fresh air. Instead of just looking at whether you’ve paid back loans, lenders can now check things like: Do you pay your electricity bill on time? How regular are your mobile recharges? Are you making steady payments for your kids’ school fees or your monthly rent?

Suddenly, people like my mom - who’ve always been financially responsible but never needed a loan, have a way to prove their creditworthiness. It’s not just about ticking boxes; it’s about recognizing real-world financial discipline.

And the benefits go both ways. Lenders get access to a whole new pool of potential customers. Instead of just competing for the same old creditworthy folks, they can reach out to new-to-credit borrowers, rural families, gig workers, and small business owners.

What counts as alternative data?#

Indian lenders have now started embracing alternative data - and not just in small numbers - this report by D91 Labs and FACE shows that over 80% of lenders try to use some form of alternative data in their underwriting process.

Here’s just a handful of alternative data points that may be used to underwrite.

Many fintech companies in India are already using these methods. However, they’re typically used for small-ticket size loans - larger ticket-size loans (say above INR 2L) still won’t go through on the back of alternative data alone, and will require more traditional underwriting.

A few words of caution#

Of course, this new approach isn’t perfect. Let’s go back to my mom - Even if she wanted a loan, she would absolutely flip at the thought of giving a lender permission to read her SMS’ or emails.

In a post-DPDP world, lenders now need to be super-transparent about what data they’re using and get clear consent from borrowers. Alternative data is getting used more and more - but as exciting as alternative data is, it needs to be used responsibly, so people aren’t unfairly judged or denied credit because of bad data or misunderstandings, or inaccurate tagging by the ML models.

Looking ahead#

The way I see it, alternative data is more than just a new tool for lenders - it’s a way to make the credit system fairer and more inclusive. It means people like my mom, who’ve always been responsible with money but never fit the old mold, get a chance to be seen.

As more lenders embrace these new data sources, getting a loan in India could become less about jumping through hoops and more about showing who you really are.

Check out the full report on the State of Alternative Data in India!