India’s trading boom is real — but can fintechs handle the demand?

29 Apr 2025 — ACCOUNT AGGREGATOR — FREE YOUR DATA

ACCOUNT AGGREGATOR

Retail investing has witnessed a massive growth surge. But fintechs are struggling to onboard traders smoothly. What does this mean for the future of trading apps? And how much is onboarding friction really costing the industry?

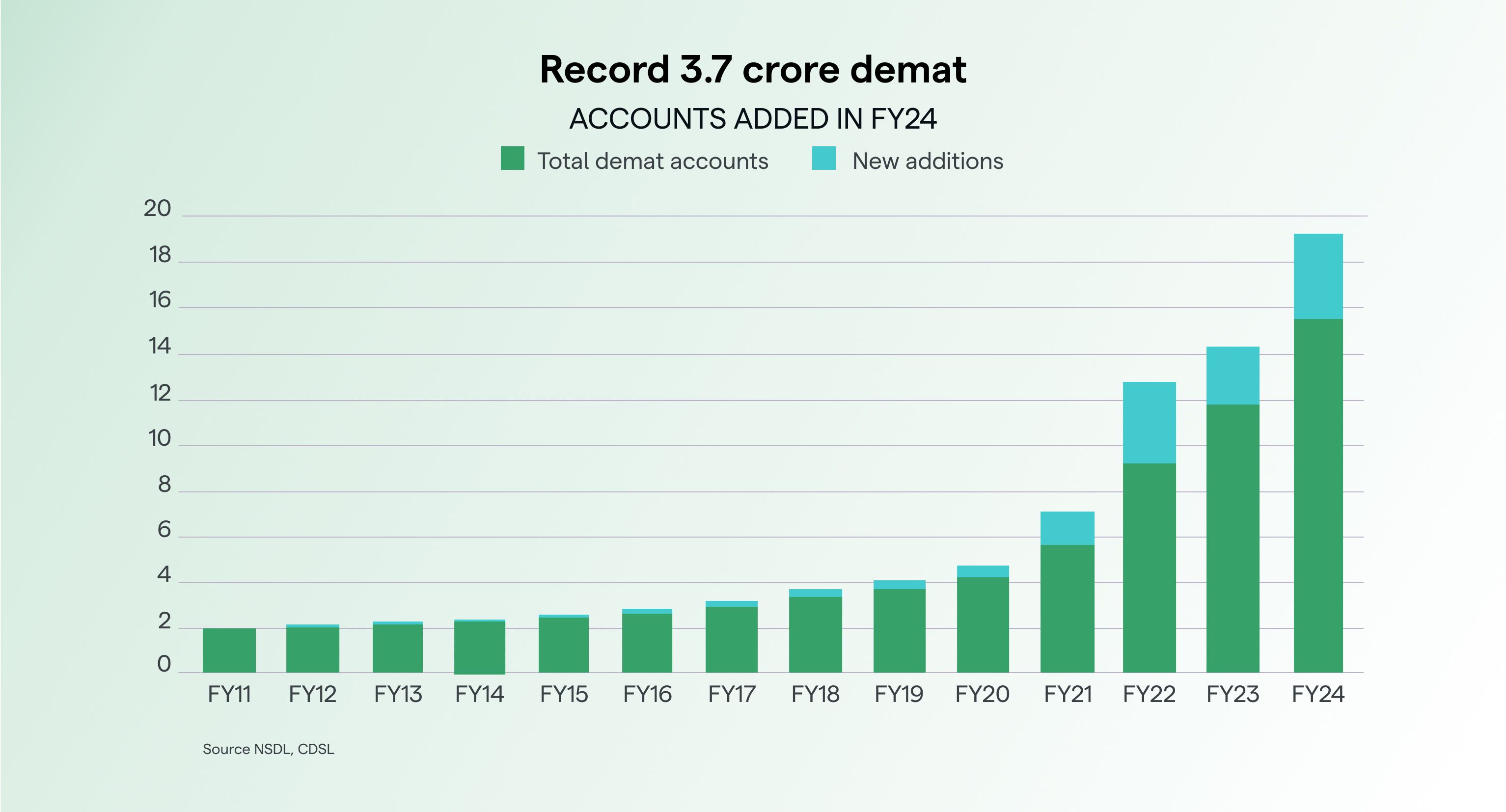

With IPL 2025 underway, you have likely noticed the flood of investment app ads. This surge of trading platforms vying for attention reveals India's rapidly evolving investment landscape—with over 10 million new demat accounts opened in 2024 alone.

And while they promise instant market access and seamless trading, in this article, we will explore the critical infrastructure powering first-time investment journeys for many Indians, and how outdated verification systems are creating significant business challenges for trading platforms.

Trading apps have nearly perfected their front-end experience. But many platforms still rely on legacy verification infrastructure—manual document verification, screen-scraping, and fragmented authentication processes. The consequences directly impact metrics that matter: conversion rate plateaus despite increased marketing spend, rising customer support tickets draining engineering resources, declining activation rates, and ultimately, stunted user growth in a competitive industry where every second matters.

For trading platforms serving tier 2 and tier 3 markets (where 60% of new investors now originate), addressing this verification infrastructure gap is about capturing market share in India's rapidly expanding investment ecosystem. Why does onboarding and verification make or break a fintech startup? And more importantly, how do you win at it? Let’s get into it. 🚀

**Fast facts: ** A 2023 Digital Onboarding Report by ebankIT highlights that 90% of financial institutions report customer abandonment during onboarding, resulting in lost business potential worth millions of dollars. On the flip side, a 2023 study by FICO found that banks with optimized digital onboarding processes experienced a 60% reduction in drop-off rates during the application process.

The True Cost of Verification Friction: Beyond Drop-offs#

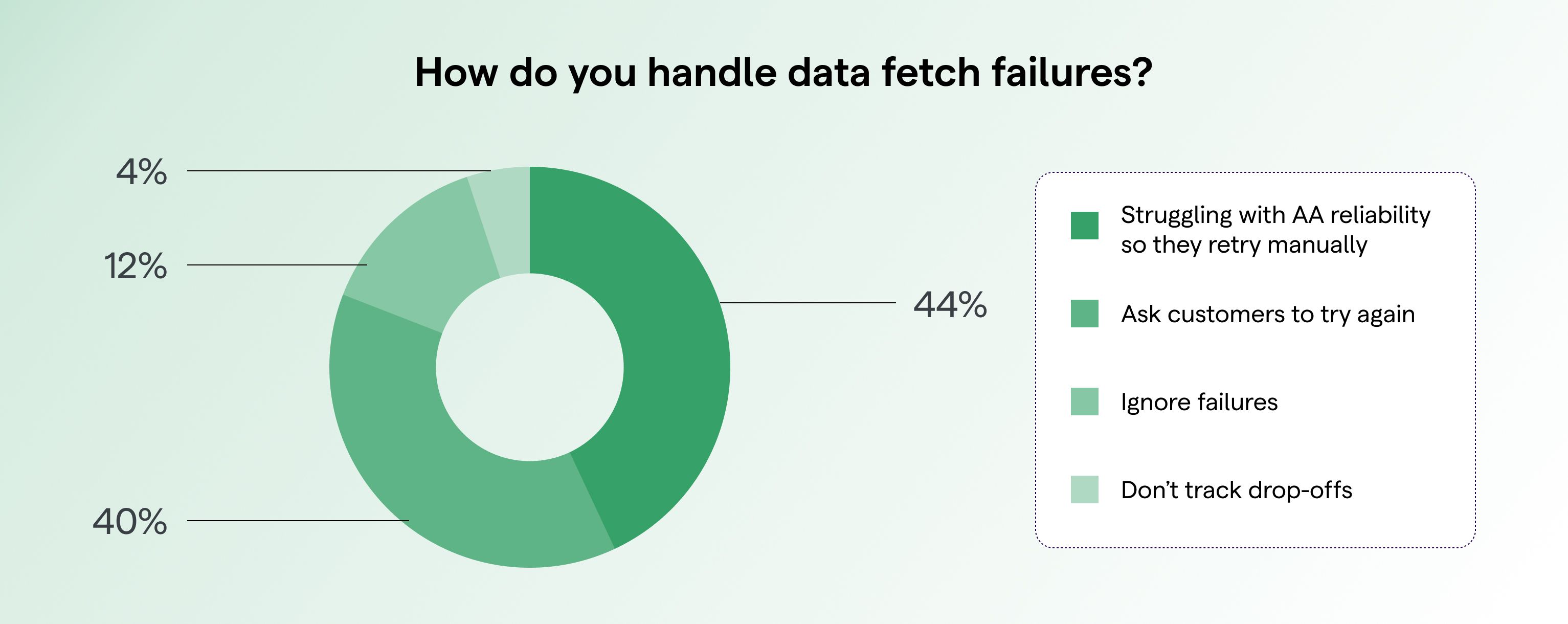

Most trading platforms track verification success through a single metric: completion rate. It makes sense. But the narrow focus also obscures the deeper impact that friction in onboarding flows create across multiple dimensions. The costs start adding up in ways that aren’t always obvious.

1. Wasted marketing spend#

Consider a trading platform that pours lakhs on IPL ads to attract new users. When potential investors click through these ads and download the app, they're at their peak interest level. But the reality is that a significant portion never completes verification, essentially turning marketing spend into a sunk cost.

Some might say, “Well, serious traders will complete verification no matter what.” But data suggests otherwise—onboarding abandonment rates spike during bank account verification. That means a significant portion of marketing spend ends up wasted on users who never get past this stage. More ad spend won’t fix this problem.

2. Engineering burnout#

Behind the scenes, verification issues drain disproportionate technical resources. Support tickets pile up. And product and engineering teams find themselves constantly triaging verification-related support tickets, implementing workarounds for bank interface changes, and maintaining legacy screen-scraping systems.

Engineers who should be building the platform’s future get stuck maintaining outdated systems instead. For many platforms, this creates a vicious cycle.

3. First impression that lasts#

For new investors, the verification process is their first encounter with your platform's capabilities. And also the first test of trust. When verification is cumbersome or fails, it doesn't just create momentary frustration.

Research from D91 Labs shows that initial friction points establish perception baselines that influence future engagement. Users who struggle through verification are naturally more hesitant to transfer larger sums or engage in more complex trading activities. The onboarding experience sets the tone for their entire journey.

4. Opportunity cost#

Signing up for a streaming service? A delay is just an annoyance. But in trading? Time is money. Markets move fast.

Trading is inherently time-sensitive. When market opportunities arise, delays in account funding directly impact a user's ability to execute their strategy. A user may have identified the perfect stock at the right price—but if verification takes too long, the trade they wanted is no longer available.

This is particularly damaging for platforms serving active traders, where the ability to quickly capitalise on market movements is central to the value proposition.

Yes, verification is necessary. And yes, some friction is unavoidable. But these costs aren't just additive. They multiply. The longer it takes to plug this leakage, the bigger the problem. And the harder it becomes to fix.

Hmm.

Case in Point: Dhan#

Perhaps the most significant shift in user expectations comes from the blurring of boundaries between financial services. When users can split restaurant bills instantly with UPI but have to wait 24+ hours to fund their trading account, the disconnect creates immediate disappointment.

This cross-category comparison is unique to India's digital ecosystem. The rapid adoption of real-time payments through UPI (6.5+ billion monthly transactions) has created a psychological benchmark for all financial transactions. Trading platforms are increasingly measured against the seamlessness of payment apps rather than against other investment services.

Dhan, one of India's fastest-growing trading platforms focused on active traders, experienced these challenges firsthand. Their original verification process required traders to manually enter bank account details and IFSC codes—information that traders rarely had at their fingertips.

Read the full case study on how Dhan solved this challenge here →

"Traditional verification was not only time-consuming but prone to errors," explains Anirudha Basak, Sr. Product Manager at Dhan. "Our target users—active traders—are particularly sensitive to market timing. Even minor delays can mean missed opportunities."

Beyond the user experience challenges, Dhan found themselves allocating increasing engineering resources to maintain their verification infrastructure. Each time a partner bank updated their interface, it required urgent engineering intervention to prevent verification failures.

"We were constantly in firefighting mode," he notes. "Our engineering resources were increasingly diverted from building new features to simply maintaining the status quo for verification. The technical debt was growing exponentially."

"If manual verification leads to delays, users may not pursue their trading strategy, leading to drop-offs," he explains. This created a sizable impact on conversion rates and initial trading volumes.

Strategic Capability, Not Just Infrastructure#

Leading trading platforms now approach verification as a strategic capability that directly impacts business metrics rather than just a technical necessity. This perspective shift has driven investment in verification systems that prioritize reliability, speed, and user experience—turning what was once a friction point into a competitive advantage.

Trading operates on a different clock than other financial services. The time-sensitive nature of market opportunities creates unique requirements that one-size-fits-all solutions were never designed to handle at the speed and scale of modern day trading.

India's Account Aggregator ecosystem emerges as a powerful foundation for this transformation, enabling a consent-based verification process that enhances both security and convenience. This balance, however, has historically been difficult to achieve in financial services.

Trading platforms leveraging this infrastructure are seeing significant operational improvements. However, the real competitive advantage comes not from simply connecting to this ecosystem, but from how platforms architect their verification systems to maximise its capabilities.

"The time for bank verification, eSign verification, F&O verification - all have reduced significantly, apart from being seamless for the user," Anirudha Basak, Sr. Product Manager - Dhan

See here to learn how Dhan did it →

Rapid Implementation, Immediate Impact#

The distinction between basic implementation and strategic architecture becomes evident in business outcomes. Strategic verification orchestration delivers:

-

Conversion Rate Stability - While basic implementations often see fluctuations in verification success rates during bank system updates or AA provider maintenance periods, orchestrated approaches maintain more consistent completion rates through intelligent routing and fallback mechanisms.

-

Engineering Focus Recapture - Platforms can significantly reduce the engineering resources needed for verification maintenance, freeing technical talent for growth-focused innovation rather than constantly addressing verification failures.

-

Support Ticket Reduction - Well-implemented orchestration substantially decreases verification-related support queries, reducing operational costs and improving overall customer satisfaction.

-

Market Timing Protection - Most critically for trading platforms, orchestration ensures traders can reliably fund accounts during market volatility, preserving the platform's core value proposition precisely when it matters most.

-

This approach ensures verification reliability without requiring trading platforms to become experts in the nuances of the AA ecosystem—allowing them to focus on their core trading capabilities while maintaining customer onboarding excellence.

Probably, the most compelling for trading platforms is how quickly these verification improvements can be implemented and their immediate business impact. Modern solutions can be integrated in weeks rather than months, with minimal engineering resources required for initial setup and ongoing maintenance.

This efficiency creates a clear business case even for platforms with limited technical resources. When verification enhancements can be implemented quickly and show measurable improvements in conversion rates within the first month, the return on investment becomes compelling.

Moving Forward: From Verification Barrier to Strategic Advantage#

As India's trading ecosystem continues its rapid evolution, verification is transforming from a necessary compliance step to a strategic advantage.

Ask yourself:

-

How many potential traders are you losing to verification failures each month?

-

What is your current verification completion rate, and how does it compare to the industry benchmark of 85%?

-

How quickly can your users move from account opening to first trade?

-

Is your verification process creating technical debt that will limit growth?

The platforms that answer these questions honestly—and act decisively—will be the ones that capture the next wave of India's trading revolution.

—------ See this transformation in action. Read the full case study here → —---