Can no-code and low-code applications boost digitisation and financial inclusion?

7 Aug 2021 — D91 LABS — TALES OF BHARAT

Ever wondered—how can a local school or a small retail store in a remote town build a digital presence and accept online payments, considering that they may not have the technical knowledge of building a website or accepting digital payments?* The short answer is that they use no-code and low-code applications.

Since you are already wondering what no-code and low-code applications are and how they work, let’s quickly understand it.

As software eats the world, the many ways of building software today can be explained using a simple analogy: Clothing. Say you have an event coming up for which you don’t have the right set of clothes. You then have multiple options—

1. You could go to a tailor, let them know what you're looking for, get your precise measurements taken and they'd ask you to come back a week later to pick up your clothes. This is usually expensive and time-consuming, but you get to customize your clothes exactly the way you want and they fit you perfectly.

Similar to the clothing analogy, the traditional way of building coded applications require a specialized development team, experienced in writing software using conventional programming languages, to understand and build the required capabilities.

2. The alternative is to go to your favorite clothing store and buy ready-made clothes for your style and size. They might not fit as perfectly as tailored clothes, but they're relatively cheaper, take very little time to buy or wear, and importantly, don’t require you to know how to stitch clothes (and neither requires you to go to a tailor). As a perk, you can choose from various available options, variations, and price ranges.

In the software world, these are known as No-code applications, which let you build applications regardless of your field or skill level, using a simple-to-use graphical interface. No-code platforms are often geared towards specific use-cases, like building a website (Squarespace), setting up your own e-commerce store (Shopify), or running your marketing campaign (Mailchimp).

3. There is an intermediate option too! When you pick up a ready-made shirt, say, from your favorite store, you might want to add a button to it or change the sleeve style as per your preference. Your neighborhood tailor could do this for you in very little time and money.

In software, these are referred to as Low-code applications. They have all the benefits of no-code but let you customize and extend the default functionality by writing very little code. Or alternatively, as a requirement, you copy-paste some very minimal code to your application and the Low-code platform takes care of the rest.

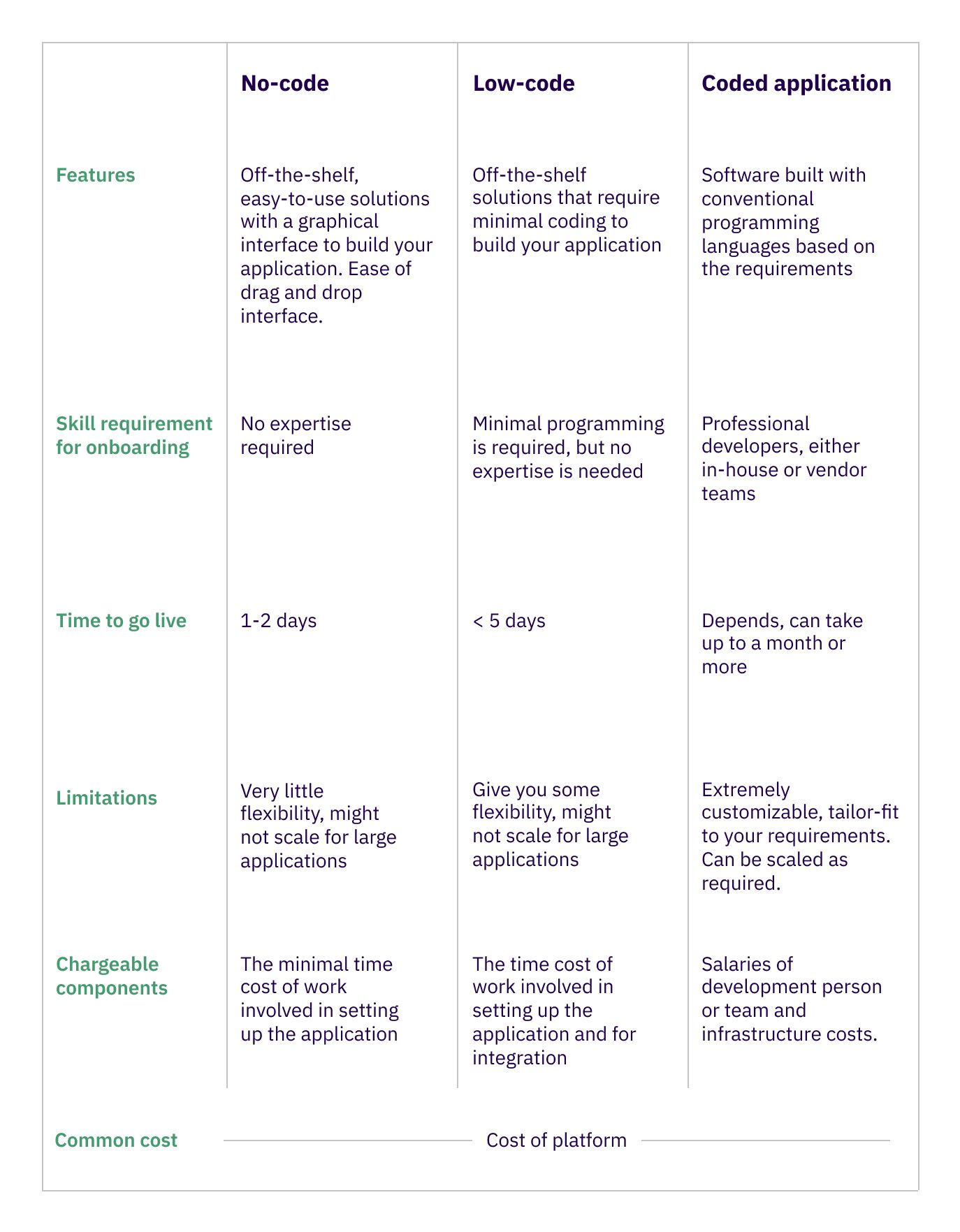

Here’s a quick breakdown of the difference between no-code, low-code, and coded applications:

Coming to the fintech industry, have they developed no-code/low-code tools?#

#

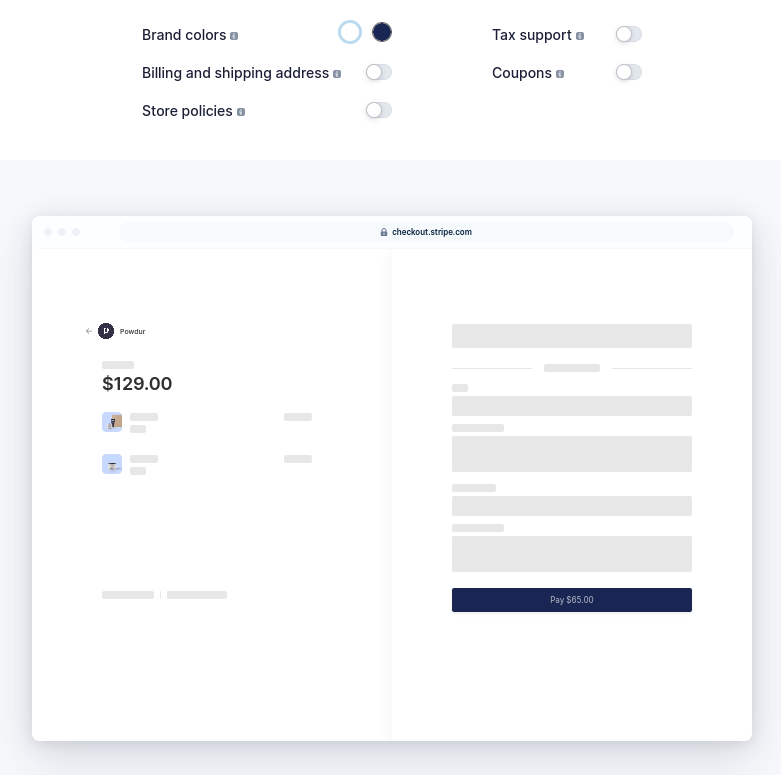

The FinTech ecosystem has embraced these models with open arms and enabled several use-cases in the past few years. A popular example of low-code integration is the checkout experience from Payment Gateway (PG) providers. One can just log in to the website for a PG provider like Stripe, and configure the end-user’s country, preferred payment modes, and some branding customizations. Once set up, all that remains is to copy a few lines of code shared on the website itself and paste it into your application to instantly enable a fully working payments solution.

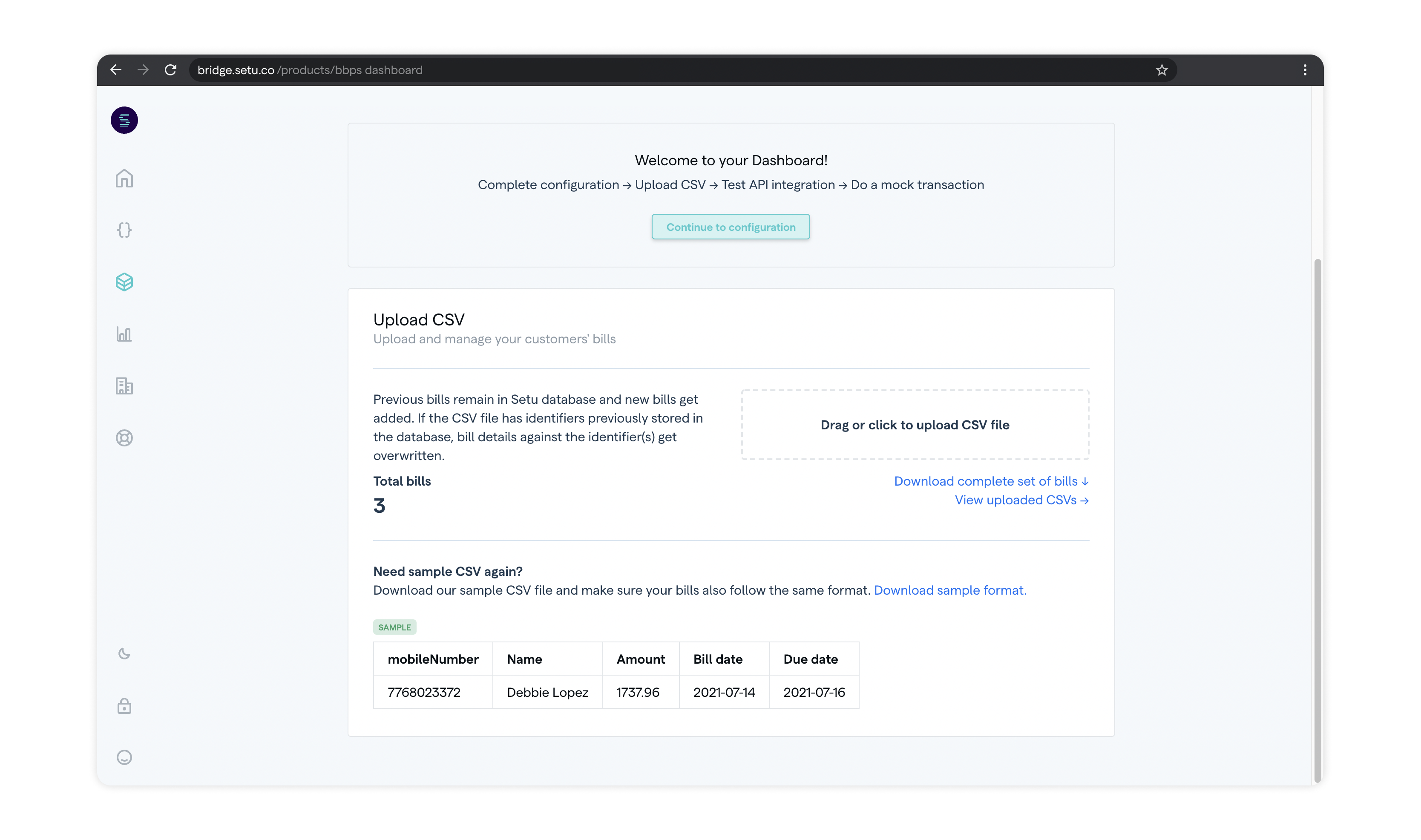

Screenshot of Stripe Payment Gateway Similar innovations have also happened with the Bharat Bill Payment System (BBPS) in India where the entire bill payments experience can be embedded onto any application with less than 10 lines of code. Such innovations let applications focus on their core offering and not have to worry about the many intricacies of supporting and handling payments themselves.

No-code innovations in the ecosystem have been in the form of enabling an easy-to-use and familiar environment for most people in the form of spreadsheets, considering their versatility in representing any kind of data.

Screenshot of Setu’s CSV application Macros on Excel or Google Sheets allow simple but effective use-cases that can be initiated merely by filling in data and triggering entire application programming interface (API) flows (like creating UPI Deeplinks for all rows corresponding to customer details). A more powerful example can be seen with Setu’s CSV1 support that lets you configure customer identifiers on the dashboard and upload a spreadsheet with matching columns to actually go live on the BBPS network, or alternatively initiate an interactive WhatsApp bot conversation that will let the user pay their bills via UPI and automatically settle money into your account. All without writing a single line of code.

Interesting! Are there no-code/low-code tools for other uses-cases too?#

Apart from Fintech, no-code and low-code applications are widely available for other use-cases too. Some examples of such applications are:

1. Building a website -

No-code website applications such as squarespace, webflow, dorik allow the users to build visually appealing, functional, and beginner-friendly websites with inbuilt drag and drop options for templates, icons, and other features. These tools are a good way to kickstart a global digital presence of one’s business in very little time. It does not require any technical training or knowledge of programming languages.

For instance, if a Madhubani painter living in a rural town of Bihar wants to create a website displaying pictures of her painting, she (or someone in her family) will need a laptop, stable internet connection, and functional knowledge of using a computer. With this, she can start off building her website and sharing her creations with the world using only no-code tools.

2. Building a backend -

When the second wave of Covid hit India, several support websites spun up overnight only thanks to rapid application development supported by low-code backend tools like Airtable. Airtable allows users to create spreadsheets of data and automatically generates APIs for them, which can then be used to not just display content to users via websites or mobile apps, but also update the content without any human intervention.

3. Analytics and dashboard -

Tools that track key business metrics such as user engagement also have no-code and low-code versions. They can help users track the success of their website in reaching the target audience, understand which sections seem interesting, and help think of ways to improve upon them. Examples of such applications are Grow, Index, Graphy, Posthog, June, and many more.

Low and no-code tools are designed for multiple other use-cases such as app builder, workflow automation, form builder, subscriptions platform, etc. These tools save time, cost and offer an all-in-one approach for companies to have a holistic digital presence.

Sounds like a good idea. But are there any limitations to using such tools?#

As all things do, these solutions also have their limitations. By nature, these tools restrict the extent of customization since it’s very difficult to support the diverse needs of all sorts of customers. So, for users who need to customize these tools as per intricate business requirements or scale up to support higher traffic, developers are needed to extend the base functionality. No-code tools also become vulnerable outlets for security breaches as the tool stores your data but may not offer sufficient safeguards against online hackers. Furthermore, if a company creating such tools shuts down, there is a high chance that organizations using these tools will have business disruption.

No-low and low-code tools are a great stepping stone for a business to create a thriving online presence and compete with the existing marketplace. In India, there is a growing number of enterprises and institutions in tier-2 cities and beyond quickly moving towards the online mode of business with the help of these tools. They acquire customers, collect payments and offer digital products and services to people across the country. From a financial inclusion perspective, these emerging tools can democratize software development as well as unlock the potential that digitization brings for anyone with access to computers, phones, and stable internet. Small businesses, schools, and colleges, traders, artists, entrepreneurs can easily access these tools and join the global digital marketplace.

However, such tools should be used with caution and users should have an understanding of the risks involved in using these tools.

Special thanks to Irfan Shah and Shravan Shandilya for their useful insights.

All illustrations designed by Prajna Nayak.

Do you want to dabble in research and writing? We’ve started a new initiative at D91 Labs called The Inner Circle where we invite you all to come to collaborate with us! Curious? Read more about it here.

1 CSV refers to comma-separated values